Question: need help with this question 1. List price: $41,500; terms: 2/10, n/30; paid within the discount period. 2. Transportation-in: $800. 3. Installation: $450. 4. Cost

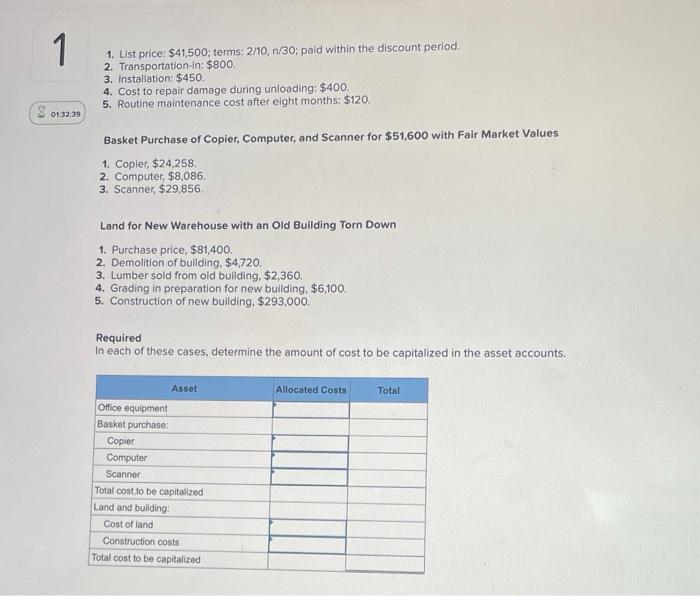

1. List price: $41,500; terms: 2/10, n/30; paid within the discount period. 2. Transportation-in: $800. 3. Installation: $450. 4. Cost to repair damage during unloading: $400. 5. Routine maintenance cost after eight month: $120. Basket Purchase of Copier, Computer, and Scanner for $51,600 with Fair Market Values 1. Copier, $24,258. 2. Computer, $8,086. 3. Scanner, $29,856. Land for New Warehouse with an Oid Building Torn Down 1. Purchase price, $81,400. 2. Demolition of building, $4,720. 3. Lumber sold from old building, $2,360. 4. Grading in preparation for new building, $6,100. 5. Construction of new building, $293,000. Required In each of these cases, determine the amount of cost to be capitalized in the asset accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts