Question: need help with this Question 15 (Mandatory) (0.6 points) Which of the following is an exchange of existing shares for a different (usually larger) number

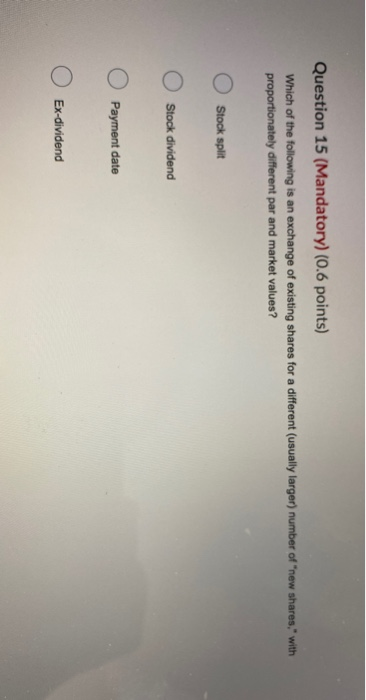

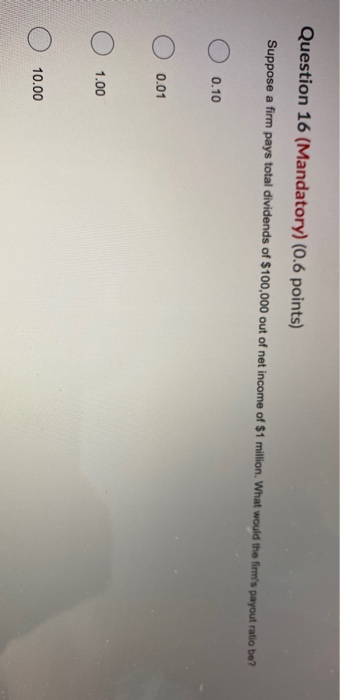

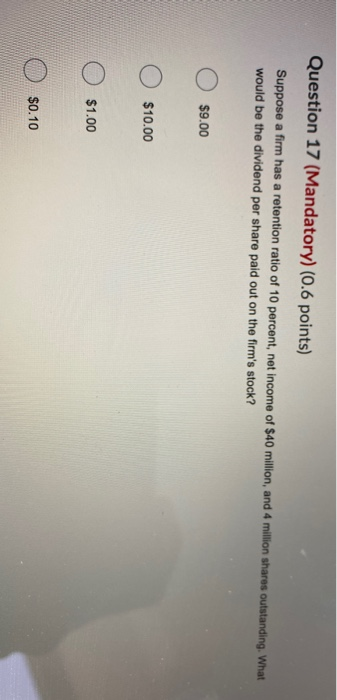

Question 15 (Mandatory) (0.6 points) Which of the following is an exchange of existing shares for a different (usually larger) number of "new shares," with proportionately different par and market values? O Stock split O Stock dividend Payment date Ex-dividend Question 16 (Mandatory) (0.6 points) Suppose a firm pays total dividends of $100,000 out of net income of $1 million. What would the firm's payout ratio be? 0.10 0.01 1.00 10.00 . Question 17 (Mandatory) (0.6 points) Suppose a firm has a retention ratio of 10 percent, net income of $40 million, and 4 million shares outstanding. What would be the dividend per share paid out on the firm's stock? . $9.00 $10.00 $1.00 $0.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts