Question: need help with this question (2) The bank statement for Dillon Company indicates a balance of $1,730 on June 30. The cash balance per books

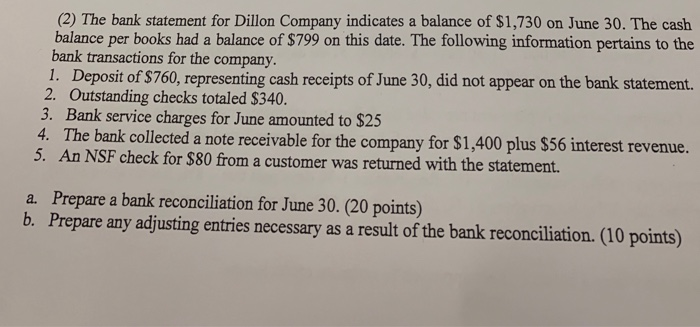

(2) The bank statement for Dillon Company indicates a balance of $1,730 on June 30. The cash balance per books had a balance of $799 on this date. The following information pertains to the bank transactions for the company. 1. Deposit of $760, representing cash receipts of June 30, did not appear on the bank statement. 2. Outstanding checks totaled $340. 3. Bank service charges for June amounted to $25 4. The bank collected a note receivable for the company for $1,400 plus $56 interest revenue. 5. An NSF check for $80 from a customer was returned with the statement. a. Prepare a bank reconciliation for June 30. (20 points) b. Prepare any adjusting entries necessary as a result of the bank reconciliation. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts