Question: need help with this question asap please and thank u this is all the information Assume today's 6-month forward rate is 7% and every 6

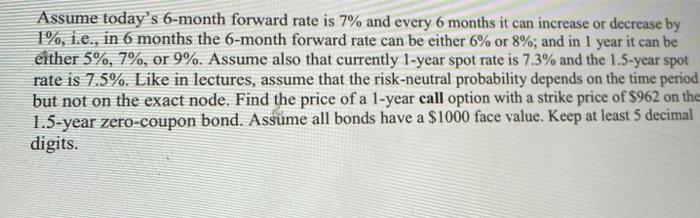

Assume today's 6-month forward rate is 7% and every 6 months it can increase or decrease by 1%, i.e., in 6 months the 6-month forward rate can be either 6% or 8%; and in 1 year it can be either 5%, 7%, or 9%. Assume also that currently 1-year spot rate is 7.3% and the 1.5-year spot rate is 7.5%. Like in lectures, assume that the risk-neutral probability depends on the time period but not on the exact node. Find the price of a 1-year call option with a strike price of $962 on the 1.5-year zero-coupon bond. Assume all bonds have a $1000 face value. Keep at least 5 decimal digits. a Assume today's 6-month forward rate is 7% and every 6 months it can increase or decrease by 1%, i.e., in 6 months the 6-month forward rate can be either 6% or 8%; and in 1 year it can be either 5%, 7%, or 9%. Assume also that currently 1-year spot rate is 7.3% and the 1.5-year spot rate is 7.5%. Like in lectures, assume that the risk-neutral probability depends on the time period but not on the exact node. Find the price of a 1-year call option with a strike price of $962 on the 1.5-year zero-coupon bond. Assume all bonds have a $1000 face value. Keep at least 5 decimal digits. a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts