Question: Need help with this question Assignment/takeAssignmentMain do? invoker assignments&takeAssignmentsessionLocator as gnment takeBinprogress false 16-45 (LO, 5, 6) swallow Company is a large real estate construction

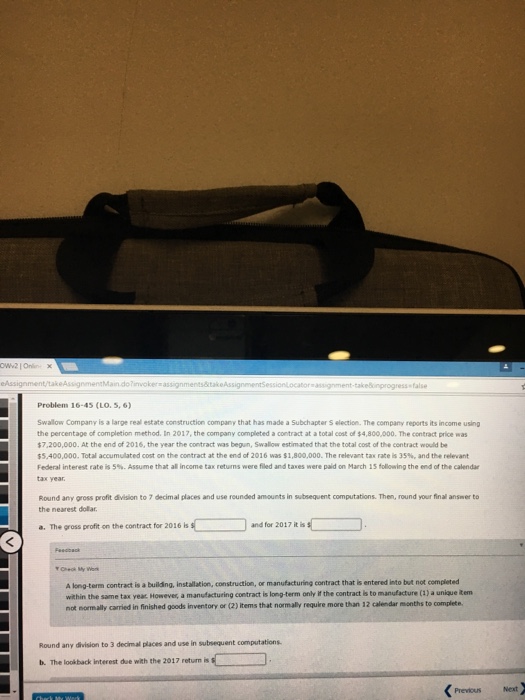

Assignment/takeAssignmentMain do? invoker assignments&takeAssignmentsessionLocator as gnment takeBinprogress false 16-45 (LO, 5, 6) swallow Company is a large real estate construction company that has made a subchapter s election. The company reports its income using the percentage of com pletion method. In 2017, the company completed a contract at a total cost of s4,800,000. The contract price $7,200,000. At the end of 2016, the year the contract was begun, swallow estimated that the total cost of the contract would be s5A00,000. Total accumulated cost on the contract at the end of 2016 was s1.800.000. The relevant tax rate is 35%, and the relevant Federal interest rate is 5%. Assume that al income tax returns were filed and taxes were on March 15 the end of the calendar subsequent computations. Then, round your final answer to Round any gross profit division to 7 decimal places and use rounded amounts the nearest dollar. and for 2017 it is on the contract for 2016 is a. The gross profit A long-term contract is a building, installation, construction, or manufacturing contract that is entered into but not completed within the same tax year. However, a manufacturing contract is long-term only ir the contract is to 1) a unique tem not normally carried in finished goods inventory or (2) items that normally require more than 12 calendar months to complet Round any division to 3 decimal places and use in subsequent computations. b. The lookback interest due with the 2017 retum is Assignment/takeAssignmentMain do? invoker assignments&takeAssignmentsessionLocator as gnment takeBinprogress false 16-45 (LO, 5, 6) swallow Company is a large real estate construction company that has made a subchapter s election. The company reports its income using the percentage of com pletion method. In 2017, the company completed a contract at a total cost of s4,800,000. The contract price $7,200,000. At the end of 2016, the year the contract was begun, swallow estimated that the total cost of the contract would be s5A00,000. Total accumulated cost on the contract at the end of 2016 was s1.800.000. The relevant tax rate is 35%, and the relevant Federal interest rate is 5%. Assume that al income tax returns were filed and taxes were on March 15 the end of the calendar subsequent computations. Then, round your final answer to Round any gross profit division to 7 decimal places and use rounded amounts the nearest dollar. and for 2017 it is on the contract for 2016 is a. The gross profit A long-term contract is a building, installation, construction, or manufacturing contract that is entered into but not completed within the same tax year. However, a manufacturing contract is long-term only ir the contract is to 1) a unique tem not normally carried in finished goods inventory or (2) items that normally require more than 12 calendar months to complet Round any division to 3 decimal places and use in subsequent computations. b. The lookback interest due with the 2017 retum is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts