Question: Need help with this question PLEASE ANSWER ON PAPER: An investor holds $1,000 of the bond in Table 1 and he wishes to be hedged

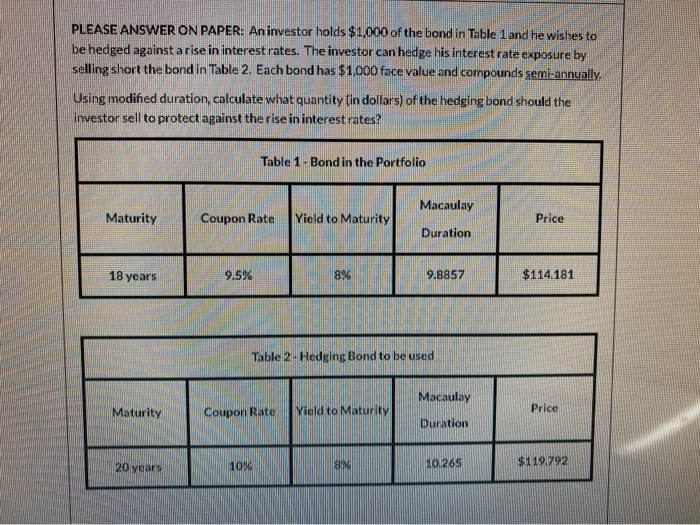

PLEASE ANSWER ON PAPER: An investor holds $1,000 of the bond in Table 1 and he wishes to be hedged against arise in interest rates. The investor can hedge his interest rate exposure by selling short the bond in Table 2. Each bond has $1,000 face value and compounds semi-annually. Using modified duration calculate what quantity (in dollars) of the hedging bond should the investor sell to protect against the rise in interest rates? Table 1 - Bond in the Portfolio Macaulay Maturity Coupon Rate Yield to Maturity Price Duration 18 years 9.5% 8% 9.8857 $114.181 Table 2-Hedging Bond to be used Macaulay Maturity Price Coupon Rate Yield to Maturity Duration 20 years 10% 8 10.265 $119.792

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts