Question: Need help with this question. Please explain if possible 11. The Bubar Building Co. has the following current financial results ($000). Revenue $45,000 Assets $37,000

Need help with this question. Please explain if possible

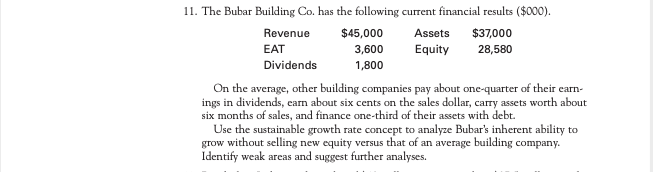

11. The Bubar Building Co. has the following current financial results ($000). Revenue $45,000 Assets $37,000 EAT 3,600 Equity 28,580 Dividends 1,800 On the average, other building companies pay about one-quarter of their carn- ings in dividends, earn about six cents on the sales dollar, carry assets worth about six months of sales, and finance one-third of their assets with debt. Use the sustainable growth rate concept to analyze Bubar's inherent ability to grow without selling new equity versus that of an average building company. Identify weak areas and suggest further analyses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts