Question: Need help with this question please? the wrong answers on the chart. The City of Castleton's General Fund had the following post-closing trial balance at

Need help with this question please? the wrong answers on the chart.

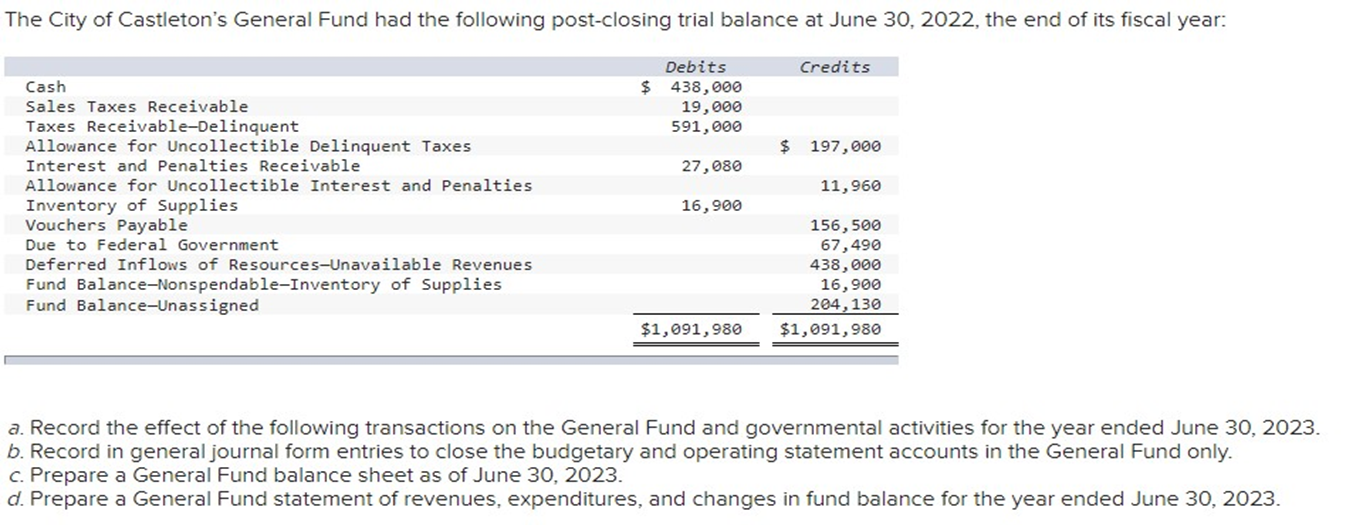

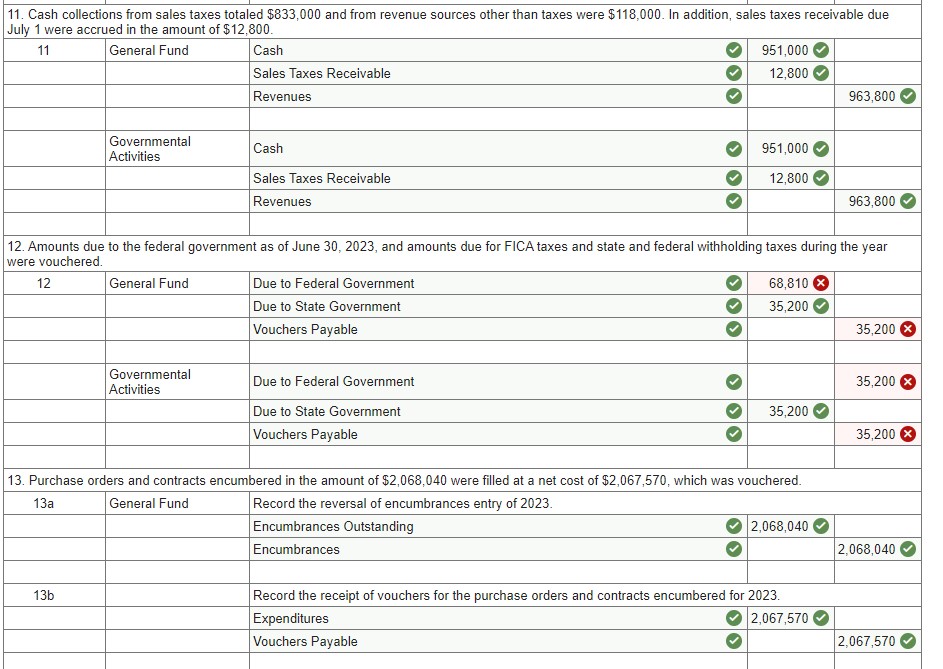

The City of Castleton's General Fund had the following post-closing trial balance at June 30. 2022. the end of its scal year: Debits Credits Cash $ 438,666 Sales Taxes Receivable 19,866 Taxes ReceivablHelinquent 591,966 Allowance for Uncollectible Delinquent Taxes 5 197,006 Interest and Penalties Receivable 27,686 Allowance for Uncollectible Interest and Penalties 11,966 Inventory of Supplies 16,900 Vouchers Payable 156,500 Due to Federal Government 67,496 Deferred Inflows of ResourcesUnavailable Revenues 438,600 Fund BalanceNonspendableInventory of Supplies 15,908 Fund Balance-Unassigned 204,130 $1,091,986 $1,691,986 [ a. Record the effect of the following transactions on the General Fund and governmental activities for the year ended June 30, 2023. b. Record in generaljournal form entries to close the budgetary and operating statement accounts in the General Fund only. c. Prepare a General Fund balance sheet as of June 30, 2023. 0'. Prepare a General Fund statement of revenues. expenditures, and changes in fund balance for the year ended June 30, 2023. | | | I 11. Cash collections from sales taxes totaled $833,000 and from revenue sources other than taxes were $118,900. In addition, sales taxes receivable due July 1 were accrued in the amount of$12:800. 11 General Fund Cash 0 951,000 9 Sales Taxes Receivable a 12,800 a Revenues a 953,800 a Governmental Activities Cash 951,000 a Sales Taxes Receivable 12,800 a Revenues 953,801] a 12. Amounts due to the federal government as of June 30: 2023, and amounts due for FICA taxes and state and federal withholding taxes during the year were vouchered. 12 General Fund Due to Federal Government a 68,811] 9 Due to State Goven'lment a 35,200 a Vouchers Payable a 35,200 a Governmental Activities Due to Federal Government 35,201] a Due to State Govemment a 35,200 a Vouchers Payable '9 35,201] 9 13. Purchase orders and contracts encumbered in the amount of $106312!\" were lled at a net cost of $105151\"): which was vouchered. 13a General Fund Record the reversal of encumbrances entr',r of 2023. Encumbrances Outstanding o 2.058.040 a Encumbrances a 2y58,04 a 13b Record the receipt of vouchers for the purchase orders and contracts encumbered for 2023. Expenditures 9 2.051570 9 Vouchers Payable o 105151-11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts