Question: Need help with this question Ruby gave land to her niece, Erin, Ruby's basis in the land was $505,000, and its fair market value at

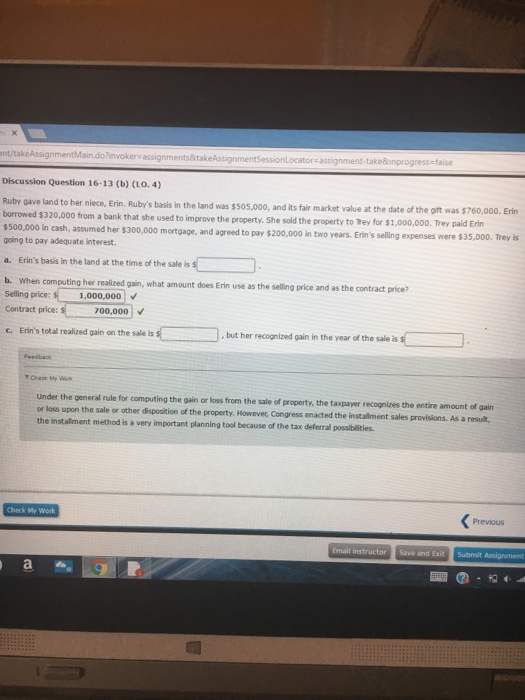

Ruby gave land to her niece, Erin, Ruby's basis in the land was $505,000, and its fair market value at the date of the gift was $760,000. Erin borrowed $320,000 from a bank that she used to improve the property. She sold the property to for $1,000,000. Trey paid Erin $500,000 in cash, assumed her $300,000 mortgage, and agreed to pay $200,000 in two years. Erin's selling expenses were $35,000. Trey is going to pay adequate interest. a. Erin's basis in the land at the time of the sale is b. When computing her realized gain, what amount does Erin use as the selling price and as the contract price? Selling price: Contract price: c. Erin's total realized gain on the sale is $ but her recognized gain in the year of the sale is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts