Question: need help with this thanks Consider a one period binomial model for a stock with current price being $4 and with the up movement u

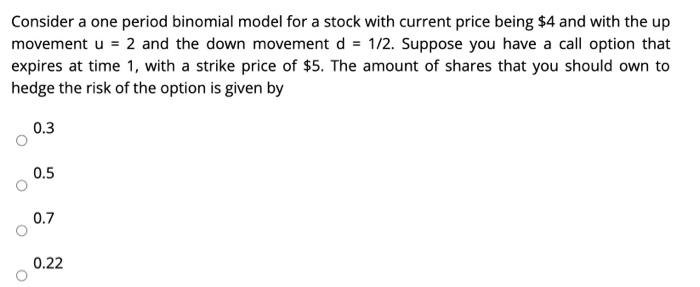

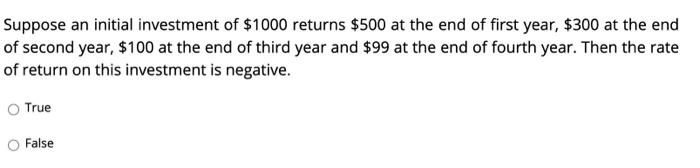

Consider a one period binomial model for a stock with current price being $4 and with the up movement u = 2 and the down movement d = 1/2. Suppose you have a call option that expires at time 1, with a strike price of $5. The amount of shares that you should own to hedge the risk of the option is given by 0.3 0.5 0.7 0.22 Suppose an initial investment of $1000 returns $500 at the end of first year, $300 at the end of second year, $100 at the end of third year and $99 at the end of fourth year. Then the rate of return on this investment is negative. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts