Question: Need help with this too thanks!! Current Attempt in Progress Ayala Architects incorporated as licensed architects on April 1, 2017. During the first month of

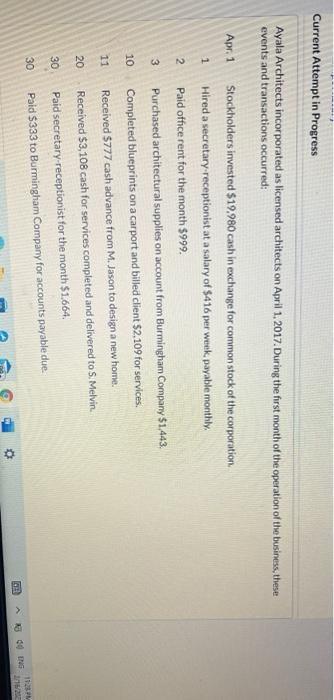

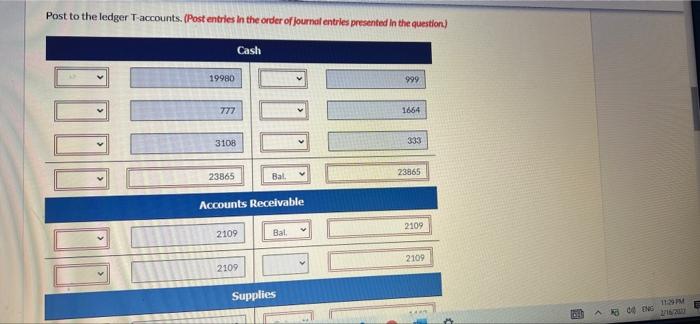

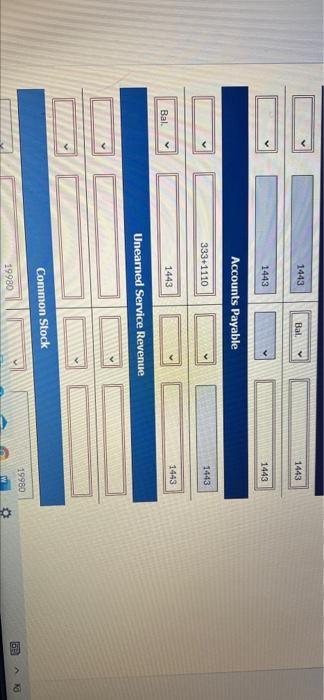

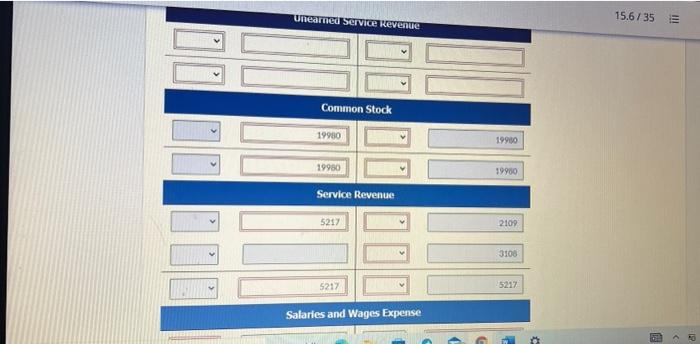

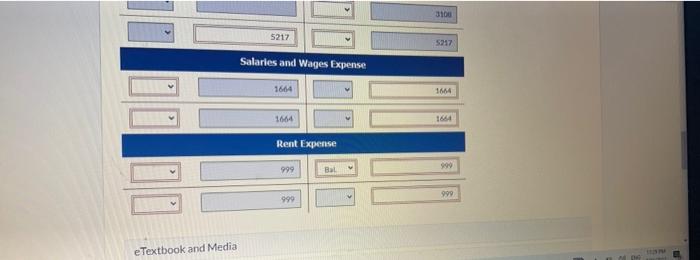

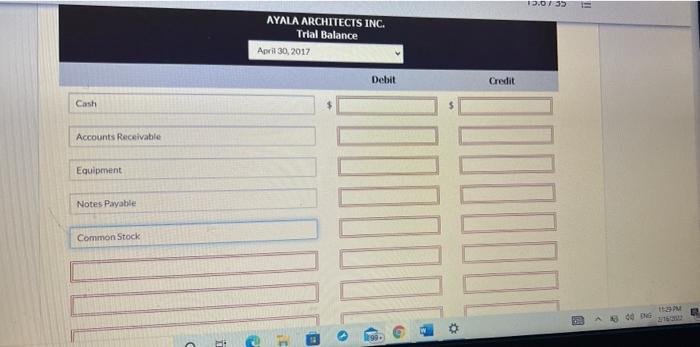

Current Attempt in Progress Ayala Architects incorporated as licensed architects on April 1, 2017. During the first month of the operation of the business, these events and transactions occurred: Apr. 1 1 2 3 10 Stockholders invested $19.980 cash in exchange for common stock of the corporation, Hired a secretary receptionist at a salary of $416 per week payable monthly Paid office rent for the month $999. Purchased architectural supplies on account from Burmingham Company $1443. Completed blueprints on a carport and billed client $2,109 for services. Received $777 cash advance from M. Jason to design a new home. Received $3,108 cash for services completed and delivered to S. Melvin. Paid secretary receptionist for the month $1,664. Paid $333 to Burmingham Company for accounts payable due 11 20 30 30 G 30 INS + Post to the ledger T-accounts. (Post entries in the order of journal entries presented in the question) Cash 19980 999 777 1664 3108 333 Bal. 23865 23865 Accounts Receivable 2109 2109 Bal 2109 2109 Supplies A3 04 ENG 1443 Bal 1443 1443 1443 Accounts Payable 333+1 110 1443 1443 1443 Bal. Unearned Service Revenue Common Stock 19980 19980 5 Unearne Service Revenue 15.6/35 = III Common Stock 19980 19950 19950 19900 Service Revenue 5217 2109 3108 5217 5217 Salaries and Wages Expense 3100 5217 5217 Salaries and Wages Expense 1664 1664 1664 1664 Rent Expense 999 999 Bal 999 999 e Textbook and Media 13.0135 AYALA ARCHITECTS INC. Trial Balance April 30, 2017 Debit Credit Cash Accounts Receivable Equipment Notes Payable Common Stock A800 DG 8) Question 5 of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts