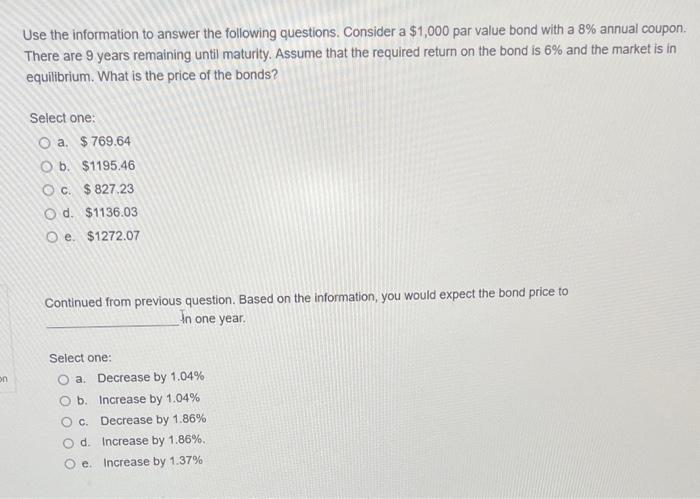

Question: need help with this Use the information to answer the following questions. Consider a $1,000 par value bond with a 8% annual coupon. There are

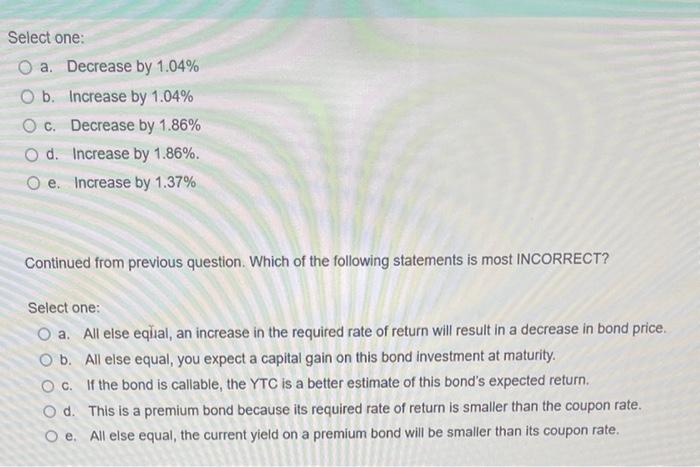

Use the information to answer the following questions. Consider a $1,000 par value bond with a 8% annual coupon. There are 9 years remaining until maturity. Assume that the required return on the bond is 6% and the market is in equilibrium. What is the price of the bonds? Select one: O a $ 769.64 O b. $1195.46 OC $ 827.23 Od: $1136.03 O e. $1272.07 Continued from previous question. Based on the information, you would expect the bond price to In one year. Select one: on O a. Decrease by 1.04% O b. Increase by 1.04% c. Decrease by 1.86% Od Increase by 1.86% O e. Increase by 1.37% Select one: O a. Decrease by 1.04% O b. Increase by 1.04% O c. Decrease by 1.86% O d. Increase by 1.86%. e. Increase by 1.37% Continued from previous question. Which of the following statements is most INCORRECT? Select one: O a. All else eqiial, an increase in the required rate of return will result in a decrease in bond price Ob. All else equal, you expect a capital gain on this bond investment at maturity. OC. If the bond is callable, the YTC is a better estimate of this bond's expected return Od. This is a premium bond because its required rate of return is smaller than the coupon rate. Oe. All else equal, the current yield on a premium bond will be smaller than its coupon rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts