Question: need help with thjs assignment On November 30th, TR Company's general ledger shows a checking account balance of $32,500. The company's cash receipts for the

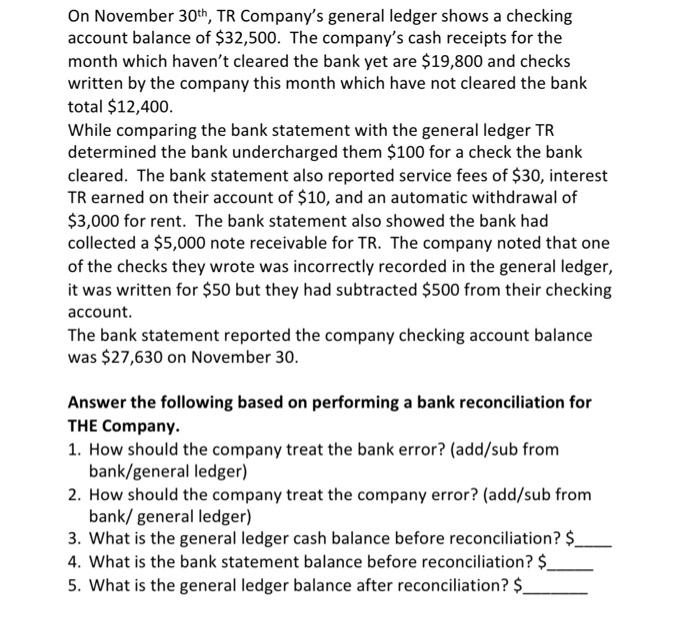

On November 30th, TR Company's general ledger shows a checking account balance of $32,500. The company's cash receipts for the month which haven't cleared the bank yet are $19,800 and checks written by the company this month which have not cleared the bank total $12,400. While comparing the bank statement with the general ledger TR determined the bank undercharged them $100 for a check the bank cleared. The bank statement also reported service fees of $30, interest TR earned on their account of $10, and an automatic withdrawal of $3,000 for rent. The bank statement also showed the bank had collected a $5,000 note receivable for TR. The company noted that one of the checks they wrote was incorrectly recorded in the general ledger, it was written for $50 but they had subtracted $500 from their checking account. The bank statement reported the company checking account balance was $27,630 on November 30 . Answer the following based on performing a bank reconciliation for THE Company. 1. How should the company treat the bank error? (add/sub from bank/general ledger) 2. How should the company treat the company error? (add/sub from bank/ general ledger) 3. What is the general ledger cash balance before reconciliation? \$ 4. What is the bank statement balance before reconciliation? \$\$ 5. What is the general ledger balance after reconciliation? \$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts