Question: Need Help with (USE ASPE) (Full Case is Attatched but only need help with these 4 issues) How to do the analysis and recommendations? Please

Need Help with (USE ASPE) (Full Case is Attatched but only need help with these 4 issues) How to do the analysis and recommendations? Please use CPA Handbook and ASPE. Just confused on these issues. What adjustments needed? Any journal entry required?

Only These Issues below:

- MedSpine is being sued for $3 million by a patient who claims that complications to his SpineX surgery were caused by a defect in the implant. MedSpine legal counsel stated that there is about 50/50 chance that MedSpine will be found liable and the estimated probable judgement would be approximately $1.5 million. MedSpine has not booked a liability related to this lawsuit.(Litigation Issue) (Which section of ASPE)

- Commissions expense has increased because the VP Sales directed Regional Controllers to record the deep discounts provided to the new distributors as commissions expense. Commissions expense is classified as an operating expense. These discounts amounted to $1.4 million.(ASPE) (Discount is not commission expense)

- Research and development costs are expensed.(Only reasearch be expensed right which ASPE section applies here?) MedSpine uses the taxes payable method to account for income taxes. Inventory is costed using the FIFO method and is stated at the lower of cost and net realizable value.(ASPE)

- SpinalHeal's Brazil regional office partnered with one of Brazil's largest medical instrument distributors - Provisao Operar Brasil (POB). POB placed an order for 480 SpineX implants and 110 of the related instrument sets for delivery in March of 2019. The surgical implants are sold for $5,100 each and the instrument sets for $1,000 each. The surgical instrument sets are customized tools without which the implant cannot be properly placed in the patient. In order to save costs POB only ordered 110 instruments as it intended to re-use the instruments for different surgeries. This is accepted practice and is approved as safe by various health and drug safety administrations worldwide, including ANVISA (the Brazilian equivalent of the U.S. Food and Drug Administration or Health Canada). A few days prior to the shipment of the order, POB notified SpinalHeal that ANVISA had issued an immediate directive prohibiting the re-use of instrument sets. As such, POB added 370 instrument sets to their order. SpinalHeal at that time did not have any additional instrument sets in inventory and was unable to fulfill this request immediately. POB decided to have the 480 implants and 110 instrument sets shipped to their warehouse and SpinalHeal recognized the related revenue of $2,558,000 on shipment. The remaining 370 instruments are still on backorder and SpinalHeal does not anticipate shipping them before February 2020. POB and the local RSD came to a verbal agreement that POB would not be required to pay for the 370 implants without related instrument sets until the order was completed and all of the instrument sets were delivered.

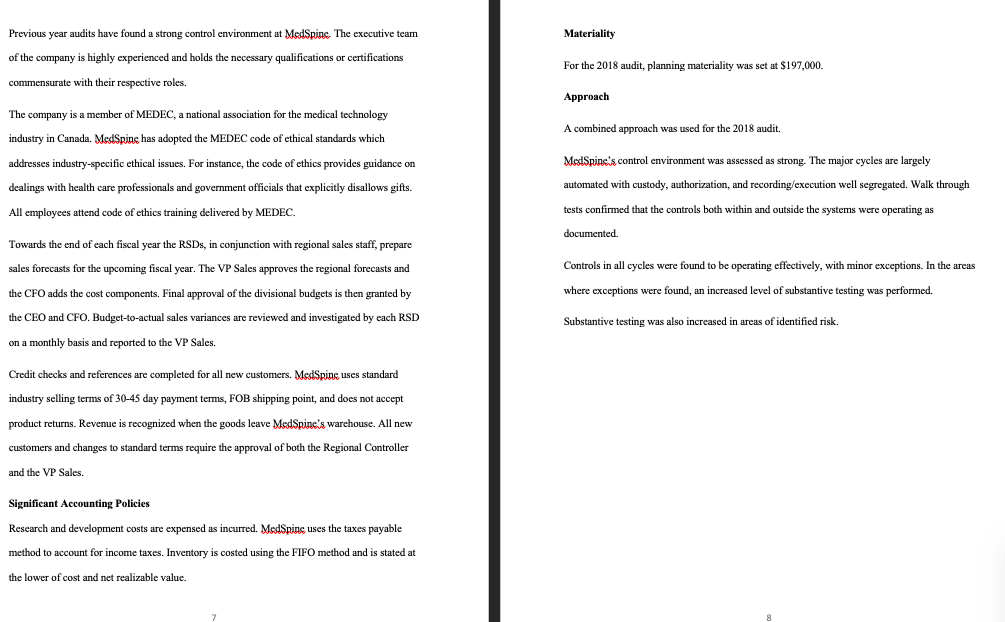

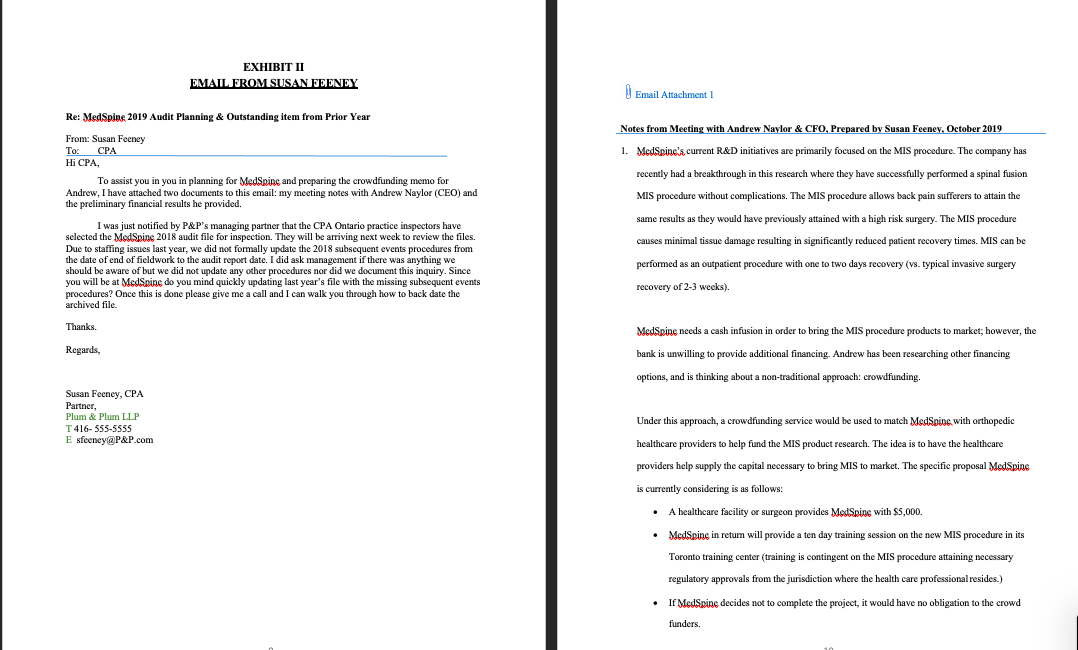

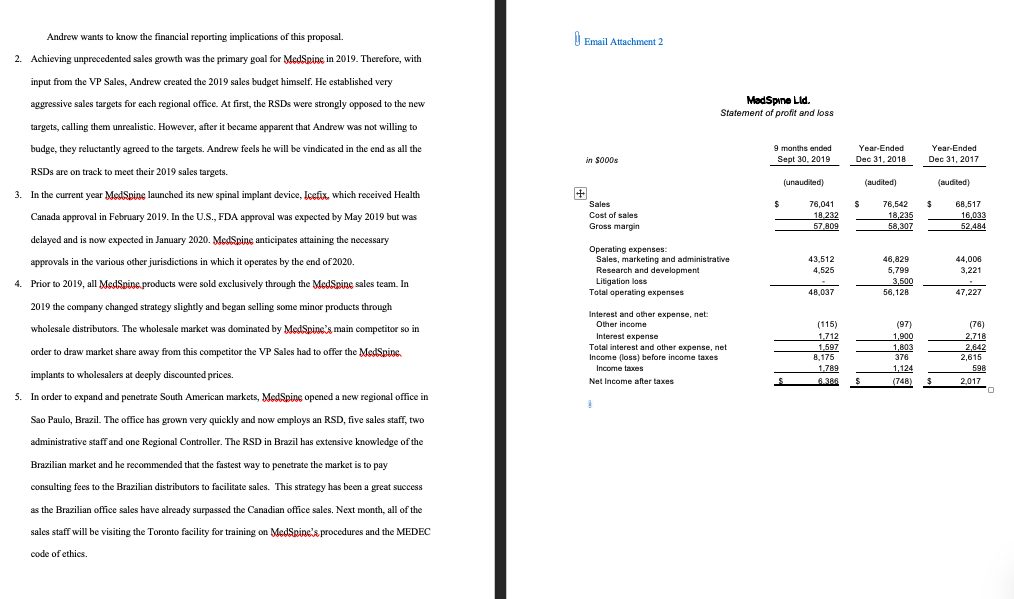

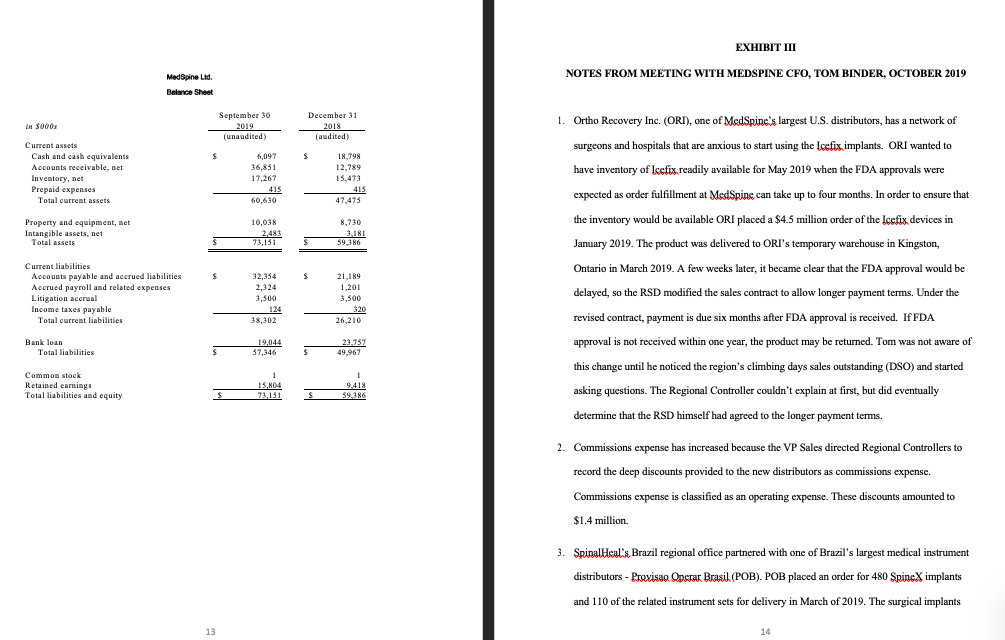

MEDSPINE LTD.: Established in 1995, MedSpine Ltd. (MedSpine) is a private medical device company which designs and manufactures reconstructive and regenerative orthopedic and spine solutions. One of MedSpine's founders, Andrew Naylor, is an orthopedic researcher who successfully developed SpineX frame devices (spinal implants) to stimulate regenerative spinal healing. He founded MedSpine with an orthopedic surgeon and a biomedical engineer. Each founder owns an equal share of the company; however, Andrew, who is also MedSpine's CEO, is the only shareholder who is actively involved in the operations. Plum & Plum LLP (P&P) has performed MedSpine's annual audit engagement for the past 15 years. It is now October 15th, 2019 and you, a CPA, have recently joined P&P as an audit manager assigned the audit of MedSpine's 2019 financial statements. MedSpine prepares its statements in accordance with Accounting Standards for Private Enterprises (ASPE) and has a December 3 1 st year-end. To get you started on the engagement, Susan Feeney (the engagement partner) briefly met with you. She advised you that based on her recent meeting with Andrew Naylor, significant change in the near future is imminent for MedSpine. Susan explained: Management is considering various options in order to secure funding to complete, and bring to market, an innovative new technology that will transform spinal surgery. I have an urgent family matter to attend to and so I will be out of town this next week, but it is important that we get the planning for this engagement started while I'm gone. Before I leave I will send you an email with notes from my meeting with Andrew and with the third quarter results for MedSpine. I have alsoscheduled a meeting for tomorrow with Tom Binder, MedSpine's CFO, and I would like you to EXHIBIT I conduct this meeting." (Excerpts from last year's working papers are included in Exhibit I. SUMMARY NOTES FROM PRIOR YEAR WORKING PAPERS The email from Susan, including her meeting notes with Andrew and related financial data, is in Overview of the Business Exhibit II. Exhibit III includes your meeting notes from your meeting with Tom). MedSpine operates in the global spine surgery market and is focused on developing spine and Susan asks you to discuss any new accounting issues that you identify and to prepare a orthopedic products. The largest market for spinal surgery is in the area of degenerative summary of adjustments. She also asks you to prepare a partial audit plan for MedSpine that conditions within the joints and disc spaces in the spine. These two conditions can result in should include: an assessment of materiality (as well as performance materiality and, if instability and pressure on the nerve roots causing back and neck pain or pain in the arms and necessary, specific performance materiality) and an assessment of the risks of material legs. In many cases there are effective non-operative treatment options; however some patients misstatement at the overall financial statement level . During her meeting with Andrew, he eventually require surgery (c.g. spinal fusion, disc replacement). MedSpine has several mentioned that he is considering crowdfunding and he wants to know the financial reporting proprietary spinal surgery products: implications. Susan asks that you prepare a draft memo in response to his request. 1. SpineX, an implant that helps correct spinal deformities 2. Formagraft, which provides scaffolding for bone grafts 3. NeuroSpins, a thoracolumbar implant used to address degenerative spinal problems 4. Icefix. MedSpine's next generation thoracolumbar implant which is in the process of being introduced 5. MIS (Minimally Invasive Surgical products), which are still in development All of MedSpine's products were internally developed except for NeuraSpine, for which the patent was purchased at a cost of $5 million several years ago. MedSpine's head office leases space adjacent to Toronto's medical district where many research hospitals are located. Head office facilities include corporate offices, a research and development (R&D) wing and a training wing. MedSpine relies on third party manufacturers to produce all of its products.Industry Background, Market and Regulatory Environment The company is also currently developing minimally invasive surgical products, referred to as The demand for spinal surgery and products is expected to increase over the next 20 years. The MIS, which are designed to minimize soft tissue disruption during surgery while providing the population segment most likely to experience back pain is that of people over the age of 50 (the surgeon with maximum viewing of the surgical area. Baby Boomers), a growing demographic. At the same time, emerging markets are expanding Organizational Structure treatment access to a greater proportion of their populations which will further increase demand The executive team, which consists of the CFO, VP Sales, VP Operations, and VP Research and for spinal surgeries. The market for spinal surgery products is intensely competitive, subject to Development, all report to the CEO. The board of directors is comprised of the 3 owners. rapid change and significantly affected by new product introductions. In addition to the Toronto-based head office, the company has three regional offices located in In Canada, the company faces a stringent regulatory environment administered by Health Canada Boston, Miami, and San Francisco. Each office employs a Regional Sales Director (RSD), sales and equivalent stringent regulatory environments in the other jurisdictions where MedSpine agents, and a Regional Controller. RSDs report to the VP Sales. All sales staff are trained in operates (e.g. U.S. Federal Drug and Food Administration (FDA)). Each of these regulators has MedSpinc's implants. Sales agents receive a compensation package which includes a established numerous pre-market clearance and approval requirements. Additional requirements combination of salary and commissions based on individual sales and total sales for their region. also exist once a product has been placed in the market. The VP Sales is awarded a bonus based on total company sales. Business Strategy The Regional Controllers maintain the books and records for their respective regions and the In order to remain competitive MedSpine must continue to develop and bring to market CFO combines the regional office results with head office. Regional Controllers report to the innovative new solutions. In 2018, the company completed all of the clinical trials for its new RSDs and have a dotted line reporting relationship to the CFO. implant system to address degenerative back problems, termed "Icefix". The trials demonstrated Financing that Icefix resulted in a reduced incidence of complications related to implant dislocation and The company's primary source of financing is a bank loan. The bank loan requires that dislodgement. As of December 2018, regulatory approval has not been attained. Approvals are MedSpine provide audited consolidated financial statements in accordance with Accounting anticipated for February 2019 in Canada and for May 2019 in the U.S. MedSpine anticipates it Standards for Private Enterprises (ASPE) within 90 days of year end. A requirement of the loan will take about three years for Icefix to fully penetrate the market, at which time Neurospine will is that the company maintain a current ratio of 1.5:1. be likely be discontinued. Control EnvironmentPrevious year audits have found a strong control environment at MedSpine The executive team Materiality of the company is highly experienced and holds the necessary qualifications or certifications For the 2018 audit, planning materiality was set at $197,000. commensurate with their respective roles. Approach The company is a member of MEDEC, a national association for the medical technology A combined approach was used for the 2018 audit. industry in Canada. MedSpine has adopted the MEDEC code of ethical standards which addresses industry-specific ethical issues. For instance, the code of ethics provides guidance on MedSpinc's control environment was assessed as strong. The major cycles are largely dealings with health care professionals and government officials that explicitly disallows gifts. automated with custody, authorization, and recording/execution well segregated. Walk through All employees attend code of ethics training delivered by MEDEC. tests confirmed that the controls both within and outside the systems were operating as documented. Towards the end of each fiscal year the RSDs, in conjunction with regional sales staff, prepare sales forecasts for the upcoming fiscal year. The VP Sales approves the regional forecasts and Controls in all cycles were found to be operating effectively, with minor exceptions. In the areas the CFO adds the cost components. Final approval of the divisional budgets is then granted by where exceptions were found, an increased level of substantive testing was performed. the CEO and CFO. Budget-to-actual sales variances are reviewed and investigated by each RSD Substantive testing was also increased in areas of identified risk. on a monthly basis and reported to the VP Sales. Credit checks and references are completed for all new customers. MedSpine uses standard industry selling terms of 30-45 day payment terms, FOB shipping point, and does not accept product returns. Revenue is recognized when the goods leave MedSpine's warehouse. All new customers and changes to standard terms require the approval of both the Regional Controller and the VP Sales. Significant Accounting Policies Research and development costs are expensed as incurred. MedSpine uses the taxes payable method to account for income taxes. Inventory is costed using the FIFO method and is stated at the lower of cost and net realizable value.EXHIBIT II EMAIL FROM SUSAN FEENEY Email Attachment 1 Re: MedSpine 2019 Audit Planning & Outstanding item from Prior Year Notes from Meeting with Andrew Naylor & CFO, Prepared by Susan Feeney, October 2019 From: Susan Feeney To: CPA 1. MedSpine's current R&D initiatives are primarily focused on the MIS procedure. The company has Hi CPA, To assist you in you in planning for MedSpine and preparing the crowdfunding memo for recently had a breakthrough in this research where they have successfully performed a spinal fusion Andrew, I have attached two documents to this email: my meeting notes with Andrew Naylor (CEO) and MIS procedure without complications. The MIS procedure allows back pain sufferers to attain the the preliminary financial results he provided. same results as they would have previously attained with a high risk surgery. The MIS procedure I was just notified by P&P's managing partner that the CPA Ontario practice inspectors have selected the ModSpine 2018 audit file for inspection. They will be arriving next week to review the files. causes minimal tissue damage resulting in significantly reduced patient recovery times. MIS can be Due to staffing issues last year, we did not formally update the 2018 subsequent events procedures from the date of end of fieldwork to the audit report date. I did ask management if there was anything we should be aware of but we did not update any other procedures nor did we document this inquiry. Since performed as an outpatient procedure with one to two days recovery (vs. typical invasive surgery you will be at MedSpine do you mind quickly updating last year's file with the missing subsequent events procedures? Once this is done please give me a call and I can walk you through how to back date the recovery of 2-3 weeks). archived file. Thanks. MedSpine needs a cash infusion in order to bring the MIS procedure products to market; however, the Regards, bank is unwilling to provide additional financing. Andrew has been researching other financing options, and is thinking about a non-traditional approach: crowdfunding. Susan Feeney, CPA Partner, Plum & Plum LLP Under this approach, a crowdfunding service would be used to match MedSpine with orthopedic T 416-555-5555 E sfeeney@P&P.com healthcare providers to help fund the MIS product research. The idea is to have the healthcare providers help supply the capital necessary to bring MIS to market. The specific proposal MedSpine is currently considering is as follows: . A healthcare facility or surgeon provides MedSpine with $5,000. . MedSpine in return will provide a ten day training session on the new MIS procedure in its Toronto training center (training is contingent on the MIS procedure attaining necessary regulatory approvals from the jurisdiction where the health care professional resides.) If MedSpine decides not to complete the project, it would have no obligation to the crowd funders.Andrew wants to know the financial reporting implications of this proposal. Email Attachment 2 2. Achieving unprecedented sales growth was the primary goal for MedSpine in 2019. Therefore, with input from the VP Sales, Andrew created the 2019 sales budget himself. He established very aggressive sales targets for each regional office. At first, the RSDs were strongly opposed to the new MadSpine Lid. Statement of profit and loss targets, calling them unrealistic. However, after it became apparent that Andrew was not willing to budge, they reluctantly agreed to the targets. Andrew feels he will be vindicated in the end as all the 9 months ended Year-Ended Year-Ended in 5000s Sept 30, 2019 Dec 31, 2018 Dec 31, 2017 RSDs are on track to meet their 2019 sales targets. (unaudited) (audited) (audited) 3. In the current year MedSpine launched its new spinal implant device, Icetix, which received Health Sales S 76,041 S 76,542 38.517 Canada approval in February 2019. In the U.S., FDA approval was expected by May 2019 but was Cost of sales 18 232 18,235 16.033 Gross margin 57.809 58,307 52,484 delayed and is now expected in January 2020. MedSpine anticipates attaining the necessary Operating expenses: approvals in the various other jurisdictions in which it operates by the end of 2020. Sales, marketing and administrative 43,512 46,829 44,006 Research and development 4,525 i,798 3,221 Prior to 2019, all MedSpine products were sold exclusively through the MedSpine sales team. In Litigation loss 3,500 Tolal operating expenses 48,037 56,128 47,227 2019 the company changed strategy slightly and began selling some minor products through Interest and other expense, net: Other income (115) (87) (76) wholesale distributors. The wholesale market was dominated by MedSpine's main competitor so in Interest expense 1.712 1,900 2,718 order to draw market share away from this competitor the VP Sales had to offer the MedSpine. Total interest and other expense, net 1.597 1,803 2,642 Income (loss) before income lakes 8,175 376 2,615 Income taxes 1,789 1,124 598 implants to wholesalers at deeply discounted prices. Net Income after taxes 8.386 (748) 2.017 5. In order to expand and penetrate South American markets, MedSpine opened a new regional office in Sao Paulo, Brazil. The office has grown very quickly and now employs an RSD, five sales staff, two administrative staff and one Regional Controller. The RSD in Brazil has extensive knowledge of the Brazilian market and he recommended that the fastest way to penetrate the market is to pay consulting fees to the Brazilian distributors to facilitate sales. This strategy has been a great success as the Brazilian office sales have already surpassed the Canadian office sales. Next month, all of the sales staff will be visiting the Toronto facility for training on MedSpine s procedures and the MEDEC code of ethics.EXHIBIT III MedSpine Lid. NOTES FROM MEETING WITH MEDSPINE CFO, TOM BINDER, OCTOBER 2019 Balance Sheet September 30 December 31 2019 2018 1. Ortho Recovery Inc. (ORD), one of MedSpine's largest U.S. distributors, has a network of [unaudited) (audited) Current assets surgeons and hospitals that are anxious to start using the Icefix implants. ORI wanted to Cash and cash equivalents 6,097 18 798 Accounts receivable, net 36,85 12,789 have inventory of Icefix readily available for May 2019 when the FDA approvals were Inventory, net 17,267 15,473 Prepaid expenses 415 415 Total current assets 60,630 47,475 expected as order fulfillment at MedSpine can take up to four months. In order to ensure that Property and equipment, net 10,038 8,730 the inventory would be available ORI placed a $4.5 million order of the Icefix devices in Intangible assets, net 2,483 3.181 Total assets 73,131 69 386 January 2019. The product was delivered to ORI's temporary warehouse in Kingston, Current liabilities Ontario in March 2019. A few weeks later, it became clear that the FDA approval would be Accounts payable and accrued liabilities 32,354 21,189 Accrued payroll and related expenses 2.324 1.201 Litigation accrual 3.500 3,500 delayed, so the RSD modified the sales contract to allow longer payment terms. Under the Income taxes payable 124 320 Total current liabilities 38,302 26,210 revised contract, payment is due six months after FDA approval is received. IfFDA Bank loan 19.04 23.757 approval is not received within one year, the product may be returned. Tom was not aware of Total liabilities 37,346 49-967 this change until he noticed the region's climbing days sales outstanding (DSO) and started Common stock Retained earnings 15,80 9.418 Total liabilities and equity 73,131 39.386 asking questions. The Regional Controller couldn't explain at first, but did eventually determine that the RSD himself had agreed to the longer payment terms. 2. Commissions expense has increased because the VP Sales directed Regional Controllers to record the deep discounts provided to the new distributors as commissions expense. Commissions expense is classified as an operating expense. These discounts amounted to $1.4 million. 3. SpinalHeal's Brazil regional office partnered with one of Brazil's largest medical instrument distributors - Provisso Operar Brasil (POB). POB placed an order for 480 SpineX implants and 110 of the related instrument sets for delivery in March of 2019. The surgical implants 13are sold for $5,100 each and the instrument sets for $1,000 each. The surgical instrument 5. Intangible assets (net of amortization) are comprised of the cost of product-related patents as sets are customized tools without which the implant cannot be properly placed in the patient. follows (stated in thousands of dollars): In order to save costs POB only ordered 110 instruments as it intended to re-use the 2019 2018 instruments for different surgeries. This is accepted practice and is approved as safe by Spinck patent 8 16 Formagraft patent 226 12 3,125 various health and drug safety administrations worldwide, including ANVISA (the Brazilian NeuroSpine patent 2,215 Icefix patent 34 28 equivalent of the U.S. Food and Drug Administration or Health Canada). Total $ 2.483 $ 3.181 A few days prior to the shipment of the order, POB notified Spinalleal that ANVISA had issued an immediate directive prohibiting the re-use of instrument sets. As such, POB added 6. Inventory is comprised of the following (stated in thousands of dollars): 370 instrument sets to their order. Spinalleal at that time did not have any additional SpineX $1,740 instrument sets in inventory and was unable to fulfill this request immediately. Formagraft 2,440 NeuroSpine 6,907 lectis 6.180 POB decided to have the 480 implants and 110 instrument sets shipped to their warehouse $17.267 7. Tom Binder provided all necessary documents to update subsequent events testing for the and Spinallcal recognized the related revenue of $2,558,000 on shipment. The remaining 2018 file. I performed and documented all audit procedures in the 2018 audit file and no 370 instruments are still on backorder and Spinall ical does not anticipate shipping them subsequent events were identified. before February 2020. POB and the local RSD came to a verbal agreement that POB would not be required to pay for the 370 implants without related instrument sets until the order was 8. MedSpine is being sued for $3 million by a patient who claims that complications to his completed and all of the instrument sets were delivered. SpineX surgery were caused by a defect in the implant. MedSpine legal counsel stated that there is about 50/50 chance that MedSpine will be found liable and the estimated probable 4. $1.1 million of the sales, marketing and admin expenses incurred by the Brazil regional judgement would be approximately $1.5 million. MedSpine has not booked a liability office consisted of consulting fees. The invoices relating to these fees were issued by POB related to this lawsuit. and another Brazilian distributor, and approved by the local RSD. Tom indicated that the invoices relating to these services lacked detail and simply stated "consulting fees for sales". When asked, the Brazilian RSD indicated that it is customary business practice in Brazil to pay distributor sales staff fees to use at their own discretion in the sales process. 15 16