Question: need help with with part A B and C question will leave a like plz help b4 11:59 Differential Analysis for o Lease op-sell Dectsion

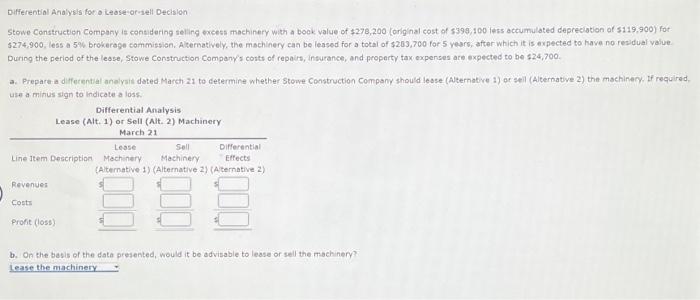

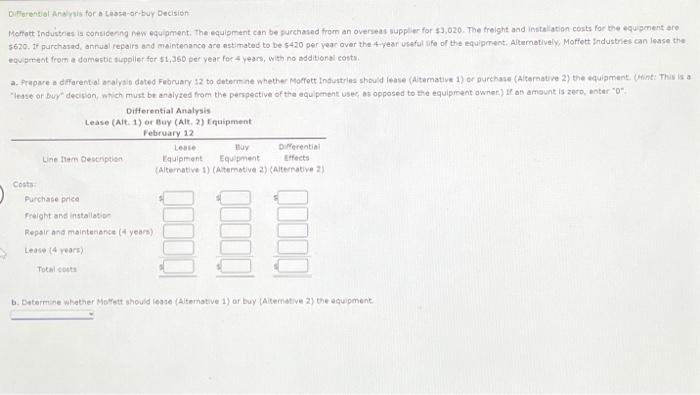

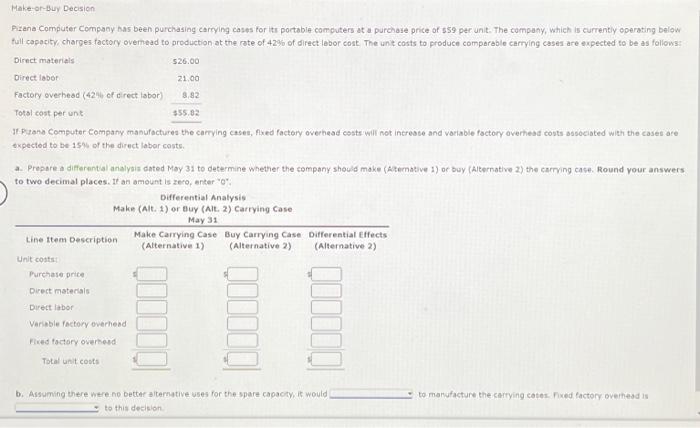

Differential Analysis for o Lease op-sell Dectsion Stowe Construction Company is considering seling excess machinery with a book value of $278,200 (oniginal cost of 5399,100 ifss actumulated depreclation of s119,900) for $274,900, less a 5% brokerage commission. Alternatively, the machinery can be leased for a total of $203,700 for 5 years, after which it is expected to have no residual value. During the period of the lesse, Stowe Construction Company's conts of repairs, insurance, and property tax experses are expected to be 524,700. use a minus sign to indicate a loss. b. On the basis of the data presented, would it be odvisable to lease or sell the machinery? Oitterensial Andrsis for a Lassa-or-buy Decision: 5620. If purchased, annual repairs and maintenance are estimated to be 5420 per vear over the 4 -vear useful sfo of the equipment. Altarnatively, Moffert industries can lease the equersect frem a domestic supplier for $1,360 per vear for 4 years, with no additsarel costs. b. Ditermine whather Moffett should lease (Ailternative 1) of buy (Aitemative 2) the equipment: Azana Computer Company has been purchasing carrying cases for its portable computers at a purchase price of s59 per unit. The company, which is currently operating below tull copocity, charpes factory ovemead to production at the rate of 42% of direct lebor cost. The unit costs to produce comparable carrying cases are expected to be as follows: If Ptean Computer Company manufactures the carrying cases, fixed factory overhesed costs will not intresse and vociable foctory averhesd costs associated with the cases are expected to be ises of the direct labor costs. a. Prepare a differental analysis dated Moy 31 to determine whether the company should make (Actemative 1) or buy (Alternative 2 ) the carring case. Round your answers to two decimal places. It an amount is zero, enter " 0 ". b. Assuming there were no better alternative vses for the spare capacty, it would to manufacture the carrying cates. Fixed factory overhead is to this decision. Differential Analysis for o Lease op-sell Dectsion Stowe Construction Company is considering seling excess machinery with a book value of $278,200 (oniginal cost of 5399,100 ifss actumulated depreclation of s119,900) for $274,900, less a 5% brokerage commission. Alternatively, the machinery can be leased for a total of $203,700 for 5 years, after which it is expected to have no residual value. During the period of the lesse, Stowe Construction Company's conts of repairs, insurance, and property tax experses are expected to be 524,700. use a minus sign to indicate a loss. b. On the basis of the data presented, would it be odvisable to lease or sell the machinery? Oitterensial Andrsis for a Lassa-or-buy Decision: 5620. If purchased, annual repairs and maintenance are estimated to be 5420 per vear over the 4 -vear useful sfo of the equipment. Altarnatively, Moffert industries can lease the equersect frem a domestic supplier for $1,360 per vear for 4 years, with no additsarel costs. b. Ditermine whather Moffett should lease (Ailternative 1) of buy (Aitemative 2) the equipment: Azana Computer Company has been purchasing carrying cases for its portable computers at a purchase price of s59 per unit. The company, which is currently operating below tull copocity, charpes factory ovemead to production at the rate of 42% of direct lebor cost. The unit costs to produce comparable carrying cases are expected to be as follows: If Ptean Computer Company manufactures the carrying cases, fixed factory overhesed costs will not intresse and vociable foctory averhesd costs associated with the cases are expected to be ises of the direct labor costs. a. Prepare a differental analysis dated Moy 31 to determine whether the company should make (Actemative 1) or buy (Alternative 2 ) the carring case. Round your answers to two decimal places. It an amount is zero, enter " 0 ". b. Assuming there were no better alternative vses for the spare capacty, it would to manufacture the carrying cates. Fixed factory overhead is to this decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts