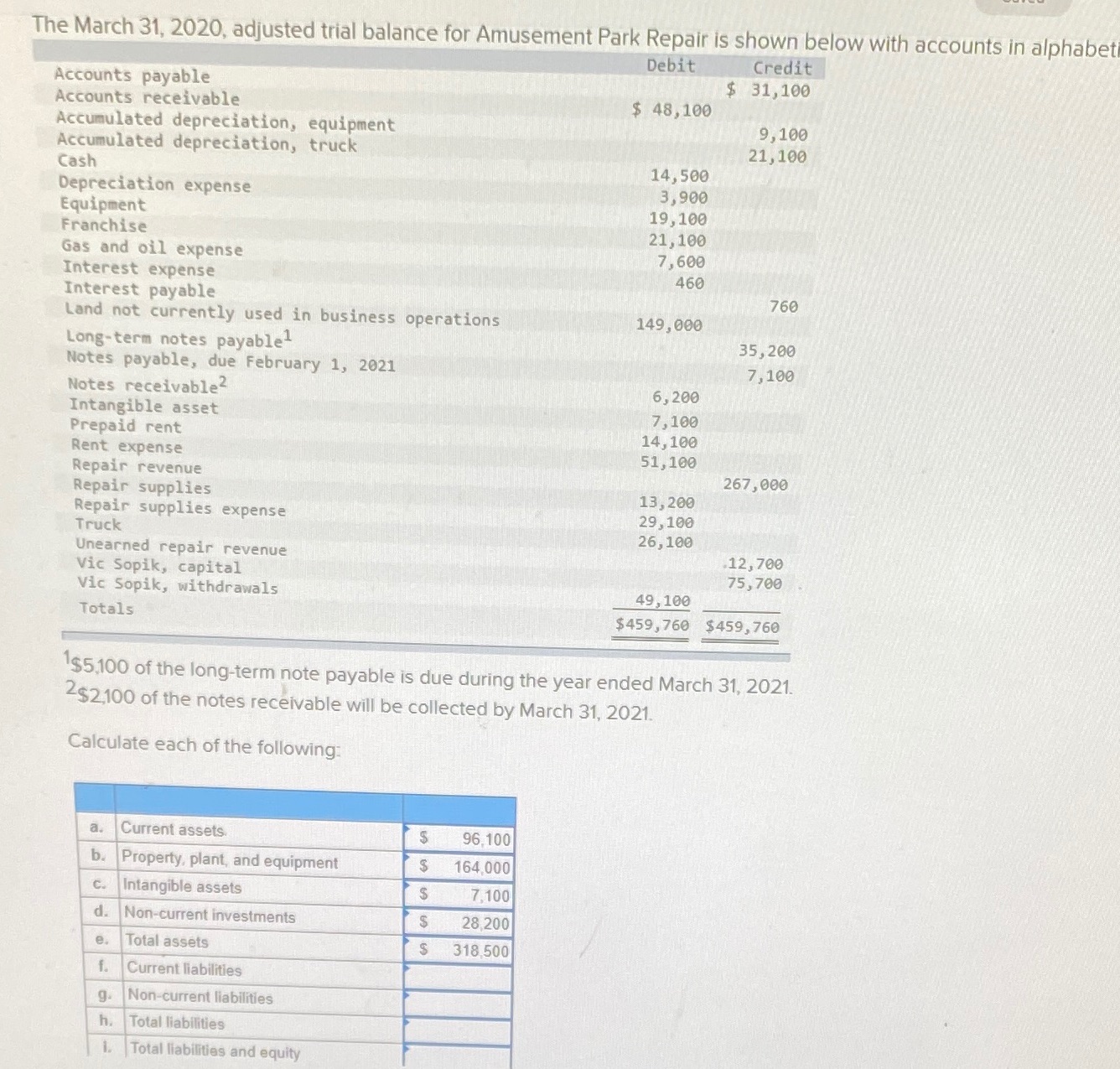

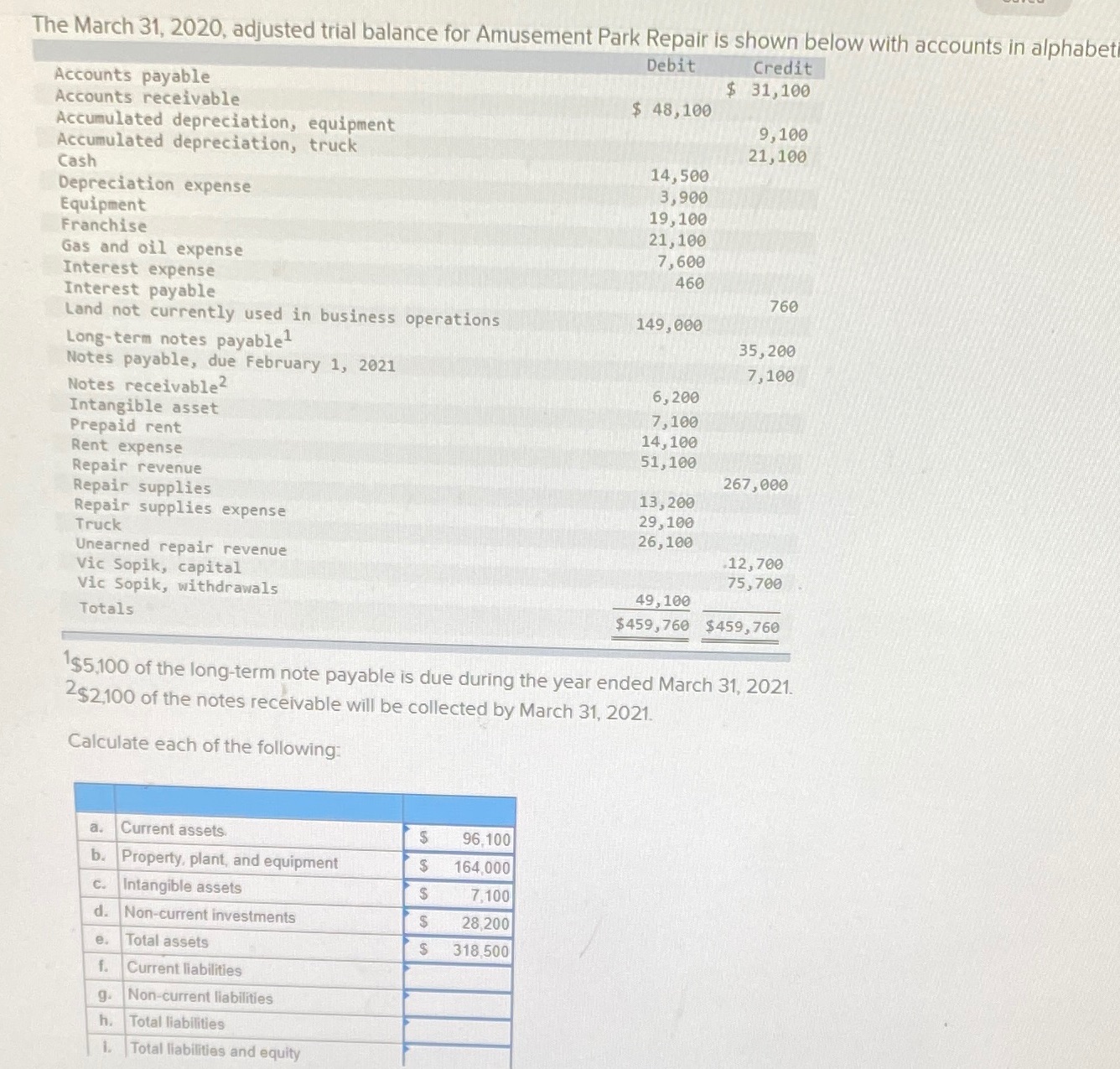

Question: Need help with With this question please, I'm having a tough time with the current and non current The March 31, 2020, adjusted trial balance

Need help with With this question please, I'm having a tough time with the current and non current

The March 31, 2020, adjusted trial balance for Amusement Park Repair is shown below with accounts in alphabet Debit Credit Accounts payable $ 31, 100 Accounts receivable $ 48, 100 Accumulated depreciation, equipment 9, 100 Accumulated depreciation, truck 21, 100 Cash 14,500 Depreciation expense 3,900 Equipment 19,100 Franchise 21, 100 Gas and oil expense 7,600 Interest expense 460 Interest payable 760 Land not currently used in business operations 149,000 Long-term notes payable 35, 200 Notes payable, due February 1, 2021 7,100 Notes receivable2 6,200 Intangible asset Prepaid rent 7, 100 14, 100 Rent expense 51, 100 Repair revenue 267,000 Repair supplies 13, 200 Repair supplies expense Truck 29, 100 26, 100 Unearned repair revenue Vic Sopik, capital 12, 706 Vic Sopik, withdrawals 75, 700 49, 100 Totals $459,760 $459,760 $5.100 of the long-term note payable is due during the year ended March 31, 2021. 2$2100 of the notes receivable will be collected by March 31, 2021. Calculate each of the following: a. Current assets $ 96,100 b. Property, plant, and equipment 164,000 C. Intangible assets 7,100 d. Non-current investments $ 28,200 e. Total assets $ 318,500 f. Current liabilities g. Non-current liabilities h. Total liabilities 1. Total liabilities and equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts