Question: need help with work out problem!! thanks in advance Mr. and Mrs. Chaulk have three dependent children, ages 3, 6, and 9. Assume the taxable

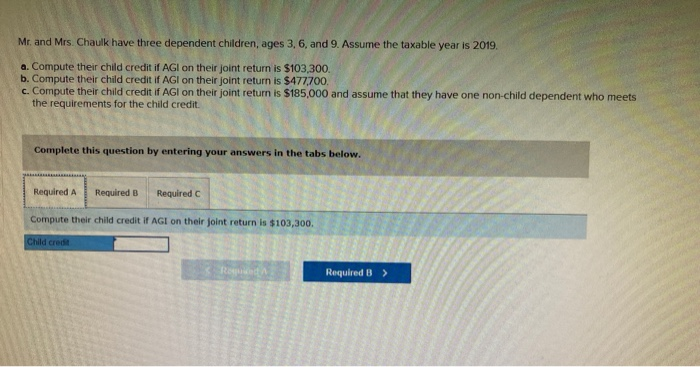

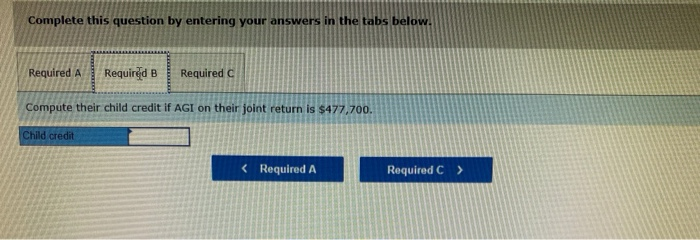

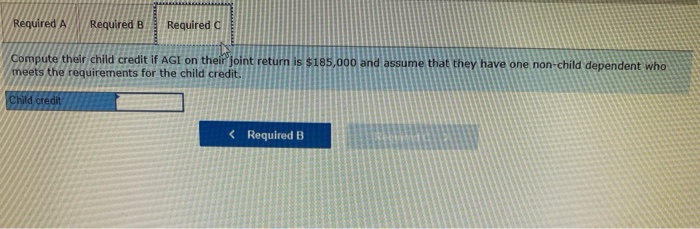

Mr. and Mrs. Chaulk have three dependent children, ages 3, 6, and 9. Assume the taxable year is 2019 a. Compute their child credit if AGI on their joint return is $103,300. b. Compute their child credit if AGI on their joint return is $477,700. c. Compute their child credit if AGI on their joint return is $185,000 and assume that they have one non-child dependent who meets the requirements for the child credit. Complete this question by entering your answers in the tabs below. Required A Required B Required Compute their child credit if AGI on their joint return is $103,300. Child crede Required B > Complete this question by entering your answers in the tabs below. Required A Required B Required Compute their child credit if AGI on their joint return is $477,700. Child credit Required A Required B Required a Compute their child credit if AGI on their joint return is $185,000 and assume that they have one non-child dependent who meets the requirements for the child credit. Child credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts