Question: need help with work out problem!! thanks in advance Ms. Barnes, an unmarried individual, has $195,900 taxable income. Assume the taxable year is 2019. Use

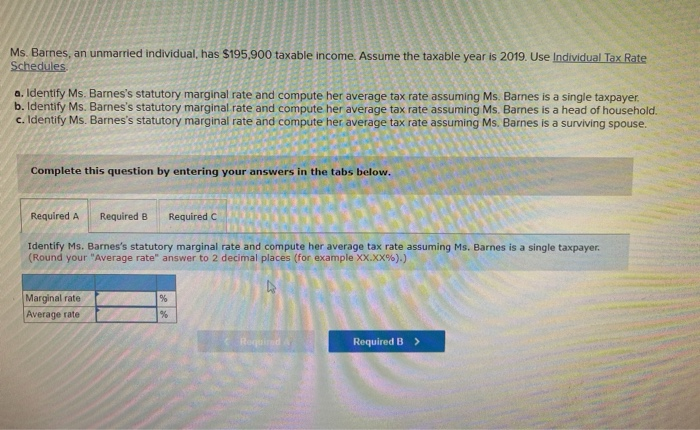

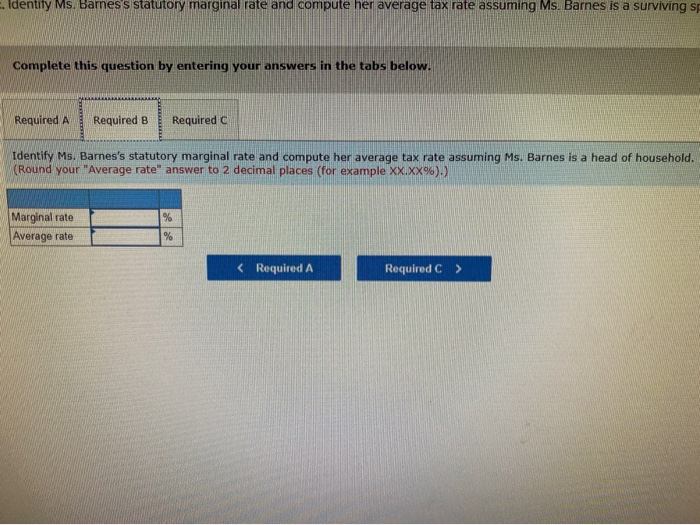

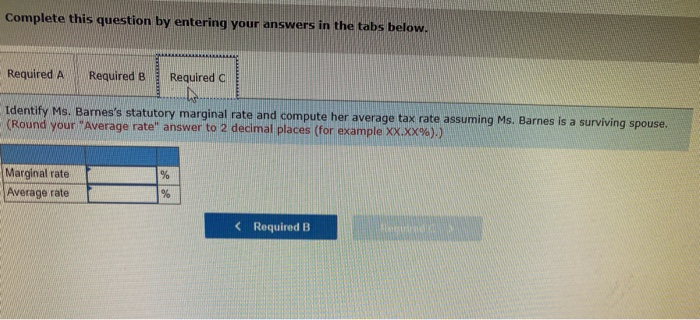

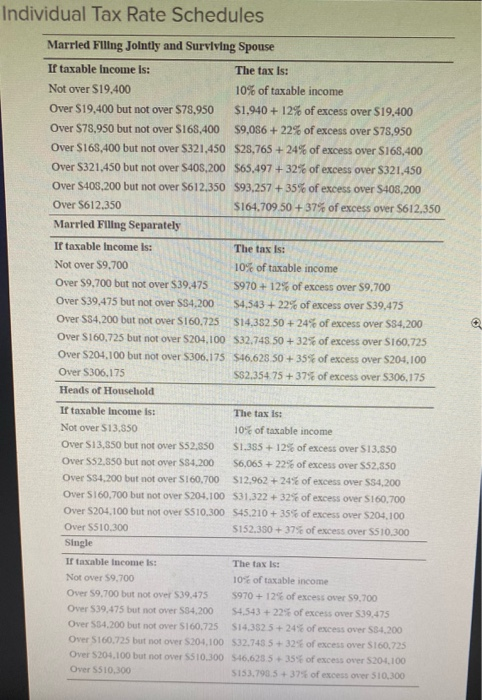

Ms. Barnes, an unmarried individual, has $195,900 taxable income. Assume the taxable year is 2019. Use Individual Tax Rate Schedules a. Identify Ms. Barnes's statutory marginal rate and compute her average tax rate assuming Ms. Barnes is a single taxpayer. b. Identify Ms. Barnes's statutory marginal rate and compute her average tax rate assuming Ms. Bames is a head of household. c. Identify Ms. Barnes's statutory marginal rate and compute her average tax rate assuming Ms. Barnes is a surviving spouse. Complete this question by entering your answers in the tabs below. Required A Required B Required c Identify Ms. Barnes's statutory marginal rate and compute her average tax rate assuming Ms. Barnes is a single taxpayer. (Round your "Average rate" answer to 2 decimal places (for example XX.XX%).) % Marginal rate Average rate % Required B > . Identity Ms. Bames s statutory marginal rate and compute her average tax rate assuming Ms. Barnes is a surviving sp Complete this question by entering your answers in the tabs below. Required A Required B Required C Identify Ms. Barnes's statutory marginal rate and compute her average tax rate assuming Ms. Barnes is a head of household. (Round your "Average rate" answer to 2 decimal places (for example XX.XX%). % Marginal rate Average rate % Complete this question by entering your answers in the tabs below. Required A Required B Required N. Identify Ms. Barnes's statutory marginal rate and compute her average tax rate assuming Ms. Barnes is a surviving spouse. (Round your "Average rate" answer to 2 decimal places (for example XX.XX%):) % Marginal rate Average rate %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts