Question: need help with xonclusions write up with respect to costs of financial distress, cost of debt, cost of capital, and capital structure if company took

need help with xonclusions write up with respect to costs of financial distress, cost of debt, cost of capital, and capital structure if company took on more debts.

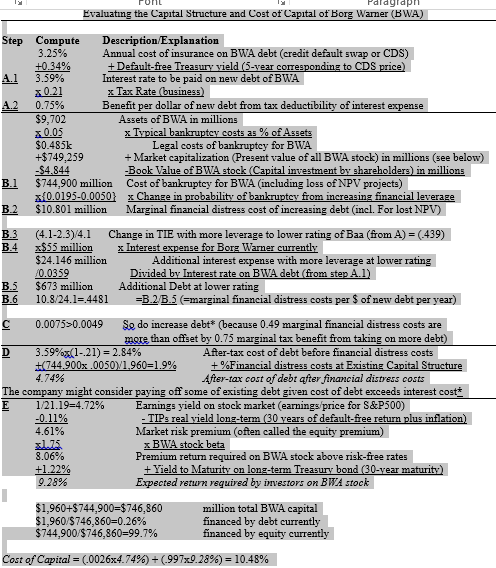

TURIL Palaylar Evaluating the Capital Structure and Cost of Capital of Borg Warner (BWA) Step A1 Compute Description Explanation 3.25% Annual cost of insurance on BWA debt (credit default swap or CDS) +0.34% + Default-free Treasury vield (5-year corresponding to CDS price) 3.59% Interest rate to be paid on new debt of BWA x0.21 x Tax Rate (business) 0.75% Benefit per dollar of new debt from tax deductibility of interest expense $9,702 Assets of BWA in millions 20.05 x Typical bankruptcy costs as % of Assets $0.485k Legal costs of bankruptcy for BWA +$749,259 + Market capitalization (Present value of all BWA stock) in millions (see below) -$4.844 -Book Value of BWA stock (Capital investment by shareholders) in millions $744,900 million Cost of bankruptcy for BWA (including loss of NPV projects) 0.0195-0.0050) x Change in probability of bankruptcy from increasing financial leverage $10.801 million Marginal financial distress cost of increasing debt (incl. For lost NPV) B1 B.2 B3 B.4 (4.1-2.3)/4.1 Change in TIE with more leverage to lower rating of Baa (from A) (439) x$55 million x Interest expense for Borg Warner currently $24.146 million Additional interest expense with more leverage at lower rating 10.0359 Divided by Interest rate on BWA debt (from step A.1) $673 million Additional Debt at lower rating 10.8/24.1= 4481 B.2/B.5 (Emarginal financial distress costs per $ of new debt per year) Divided by Interesse est expense with BS B6 $673 million C 0.0075>0.0049 So do increase debt* (because 0.49 marginal financial distress costs are more than offset by 0.75 marginal tax benefit from taking on more debt) D 3.59%x(1-21) = 2.84% After-tax cost of debt before financial distress costs +(744 900x.005071.9601.9% + %Financial distress costs at Existing Capital Structure 4.74% After-tax cost of debt after financial distress costs The company might consider paying off some of existing debt given cost of debt exceeds interest cost 1/21.19=4.72% Earnings yield on stock market (earnings price for S&P500) -0.11% - TIPs real yield long-term (30 years of default-free return plus inflation) 4.61% Market risk premium (often called the equity premium) 1.75 xBWA stock beta 8.06% Premium return required on BWA stock above risk-free rates +1.22% + Yield to Maturity on long-term Treasury bond (30-year maturity) 9.28% Expected return required by investors on BWA stock $1,960+$744,900=$746,860 $1,960/$746,860=0.26% $744,900 $746,860=99.7% million total BWA capital financed by debt currently financed by equity currently Cost of Capital = 0.0026x4.749) + (-9977:9.28%) = 10.48% TURIL Palaylar Evaluating the Capital Structure and Cost of Capital of Borg Warner (BWA) Step A1 Compute Description Explanation 3.25% Annual cost of insurance on BWA debt (credit default swap or CDS) +0.34% + Default-free Treasury vield (5-year corresponding to CDS price) 3.59% Interest rate to be paid on new debt of BWA x0.21 x Tax Rate (business) 0.75% Benefit per dollar of new debt from tax deductibility of interest expense $9,702 Assets of BWA in millions 20.05 x Typical bankruptcy costs as % of Assets $0.485k Legal costs of bankruptcy for BWA +$749,259 + Market capitalization (Present value of all BWA stock) in millions (see below) -$4.844 -Book Value of BWA stock (Capital investment by shareholders) in millions $744,900 million Cost of bankruptcy for BWA (including loss of NPV projects) 0.0195-0.0050) x Change in probability of bankruptcy from increasing financial leverage $10.801 million Marginal financial distress cost of increasing debt (incl. For lost NPV) B1 B.2 B3 B.4 (4.1-2.3)/4.1 Change in TIE with more leverage to lower rating of Baa (from A) (439) x$55 million x Interest expense for Borg Warner currently $24.146 million Additional interest expense with more leverage at lower rating 10.0359 Divided by Interest rate on BWA debt (from step A.1) $673 million Additional Debt at lower rating 10.8/24.1= 4481 B.2/B.5 (Emarginal financial distress costs per $ of new debt per year) Divided by Interesse est expense with BS B6 $673 million C 0.0075>0.0049 So do increase debt* (because 0.49 marginal financial distress costs are more than offset by 0.75 marginal tax benefit from taking on more debt) D 3.59%x(1-21) = 2.84% After-tax cost of debt before financial distress costs +(744 900x.005071.9601.9% + %Financial distress costs at Existing Capital Structure 4.74% After-tax cost of debt after financial distress costs The company might consider paying off some of existing debt given cost of debt exceeds interest cost 1/21.19=4.72% Earnings yield on stock market (earnings price for S&P500) -0.11% - TIPs real yield long-term (30 years of default-free return plus inflation) 4.61% Market risk premium (often called the equity premium) 1.75 xBWA stock beta 8.06% Premium return required on BWA stock above risk-free rates +1.22% + Yield to Maturity on long-term Treasury bond (30-year maturity) 9.28% Expected return required by investors on BWA stock $1,960+$744,900=$746,860 $1,960/$746,860=0.26% $744,900 $746,860=99.7% million total BWA capital financed by debt currently financed by equity currently Cost of Capital = 0.0026x4.749) + (-9977:9.28%) = 10.48%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts