Question: need help WITHIN 5 MINUTES PLEASE!!! Question 10 (1 point) The following totals for the month of April were taken from the payroll register of

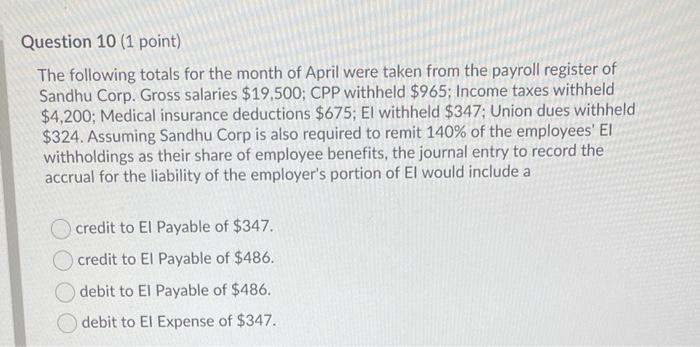

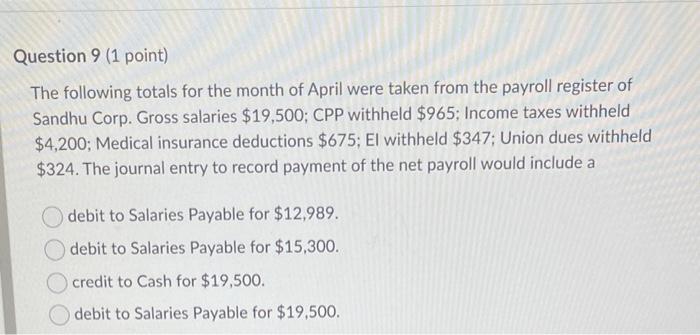

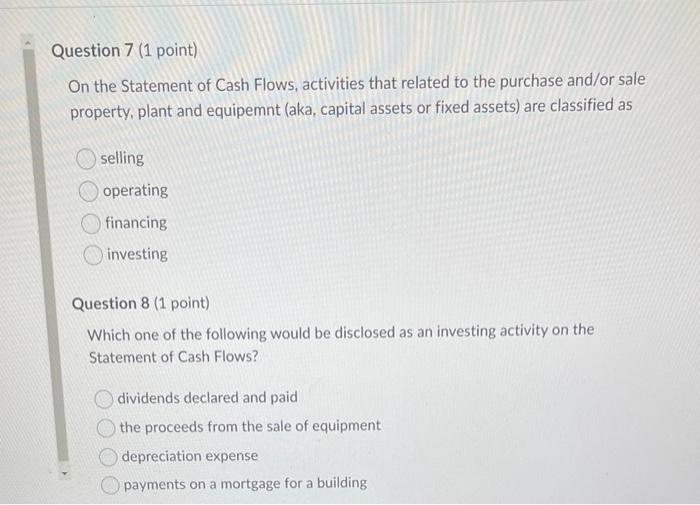

Question 10 (1 point) The following totals for the month of April were taken from the payroll register of Sandhu Corp. Gross salaries $19,500; CPP withheld $965; Income taxes withheld $4,200; Medical insurance deductions $675; El withheld $347; Union dues withheld $324. Assuming Sandhu Corp is also required to remit 140% of the employees' El withholdings as their share of employee benefits, the journal entry to record the accrual for the liability of the employer's portion of El would include a credit to El Payable of $347. credit to El Payable of $486. debit to El Payable of $486. debit to El Expense of $347. Question 9 (1 point) The following totals for the month of April were taken from the payroll register of Sandhu Corp. Gross salaries $19,500; CPP withheld $965; Income taxes withheld $4,200; Medical insurance deductions $675; El withheld $347; Union dues withheld $324. The journal entry to record payment of the net payroll would include a debit to Salaries Payable for $12,989. debit to Salaries Payable for $15,300. credit to Cash for $19,500. debit to Salaries Payable for $19,500. Question 7 (1 point) On the Statement of Cash Flows, activities that related to the purchase and/or sale property, plant and equipemnt (aka, capital assets or fixed assets) are classified as selling operating financing investing Question 8 (1 point) Which one of the following would be disclosed as an investing activity on the Statement of Cash Flows? dividends declared and paid the proceeds from the sale of equipment depreciation expense payments on a mortgage for a building

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts