Question: NEED HELP WORKING THIS OUT! Using a perpetual inventory system, record the June and July transactions in the General Journal. Retailing Chinchilla Retailers sells designer

NEED HELP WORKING THIS OUT!

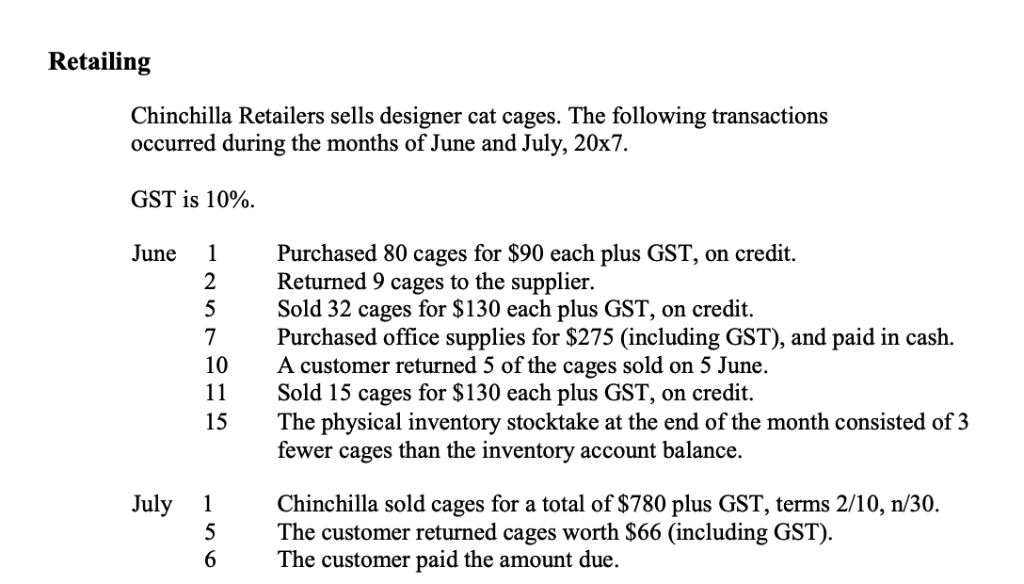

Using a perpetual inventory system, record the June and July transactions in the General Journal.

Retailing Chinchilla Retailers sells designer cat cages. The following transactions occurred during the months of June and July, 20x7 GST is 10%. Purchased 80 cages for $90 each plus GST, on credit. Returned 9 cages to the supplier. Sold 32 cages for $130 each plus GST, on credit. Purchased office supplies for $275 (including GST), and paid in cash A customer returned 5 of the cages sold on 5 June. Sold 15 cages for $130 each plus GST, on credit. The physical inventory stocktake at the end of the month consisted of 3 fewer cages than the inventory account balance. June 1 2 5 7 10 11 15 Chinchilla sold cages for a total of $780 plus GST, terms 2/10, n/30. The customer returned cages worth $66 (including GST) The customer paid the amount due. July 1 5 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts