Question: Need helping solving 5-10, any help is welcomed. 5. The yield on the 5-year T-Bond is 5.4%. The 2-year T-Bond has a yleld of 5%.

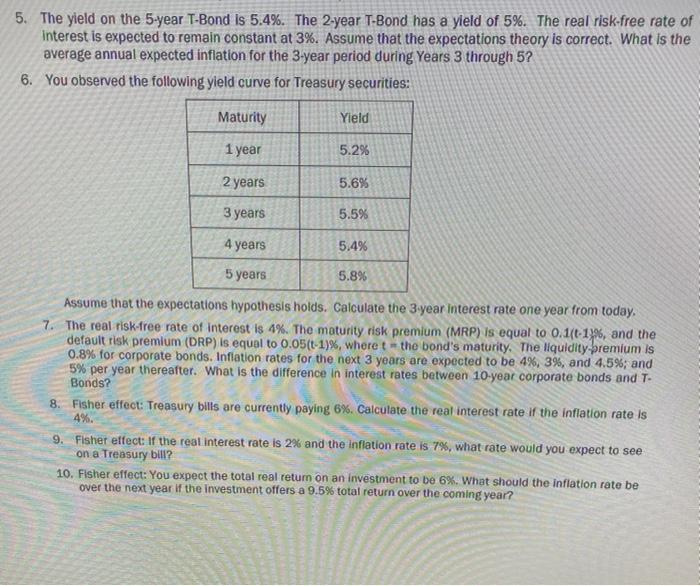

5. The yield on the 5-year T-Bond is 5.4%. The 2-year T-Bond has a yleld of 5%. The real risk-free rate of interest is expected to remain constant at 3%. Assume that the expectations theory is correct. What is the average annual expected inflation for the 3-year period during Years 3 through 5? 6. You observed the following yield curve for Treasury securities: Maturity Yield 1 year 5.2% 2 years 5.6% 3 years 5.5% 4 years 5.4% 5 years 5.8% Assume that the expectations hypothesis holds. Calculate the 3 year interest rate one year from today. 7. The real risk-free rate of interest is 4%. The maturity risk premium (MRP) is equal to 0.1(t-13%, and the default risk premium (DRP) is equal to 0.05(t-1)%, where the bond's maturity. The liquidity bremium is 0.8% for corporate bonds. Inflation rates for the next 3 years are expected to be 4%, 3%, and 4.5%; and 5% per year thereafter. What is the difference in interest rates between 10-year corporate bonds and T- Bonds? 8. Fisher effect: Treasury bills are currently paying 6%. Calculate the real interest rate if the inflation rate is 4%. 9. Fisher effects of the real interest rate is 2% and the inflation rate is 7%, what rate would you expect to see on a Treasury bill? 10. Fisher effect: You expect the total real return on an investment to be 6%. What should the inflation rate be over the next year if the investment offers a 9.5% total return over the coming year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts