Question: Need helping solving in Excel Q5. You are a consultant to a large manufacturing corporation considering a project with the following net after-tax cash flows

Need helping solving in Excel

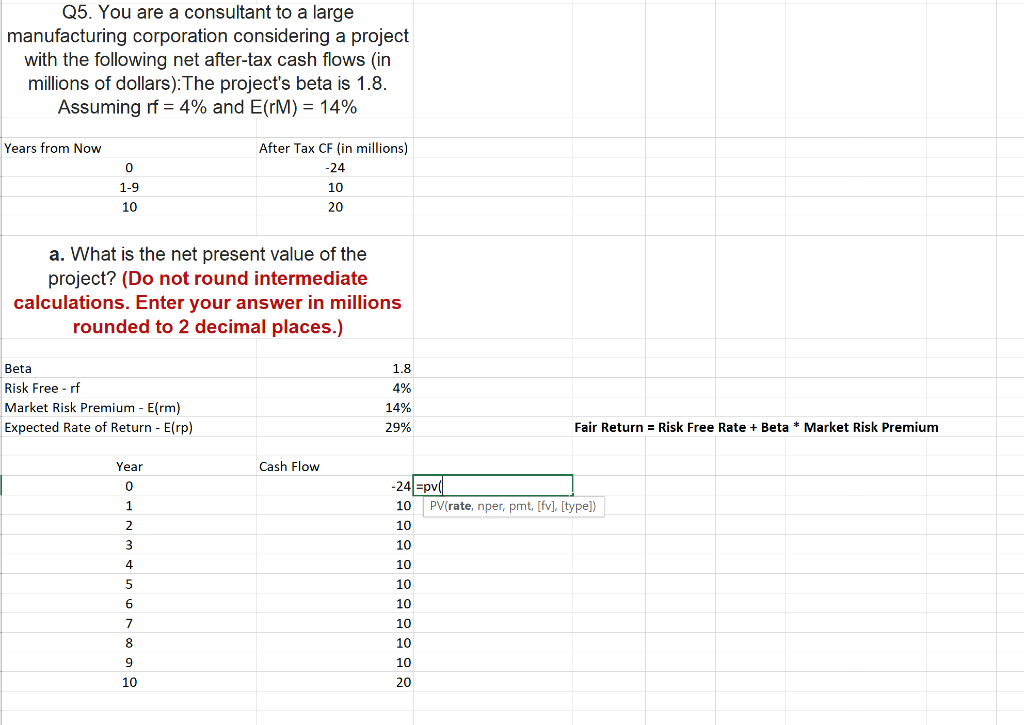

Q5. You are a consultant to a large manufacturing corporation considering a project with the following net after-tax cash flows (in millions of dollars). The project's beta is 1.8. Assuming rf = 4% and E(rM) = 14% Years from Now After Tax CF (in millions) -24 0 1-9 10 10 20 a. What is the net present value of the project? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Beta Risk Free - rf Market Risk Premium - E(rm) Expected Rate of Return - Erp) 1.8 4% 14% 29% Fair Return = Risk Free Rate + Beta * Market Risk Premium Cash Flow Year 0 1 -24 =pul 10 PV(rate, nper, pmt, [fv], [type]) 10 2 3 4 10 5 6 7 10 10 10 10 10 10 9 10 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts