Question: Need hep completing this journal enttry. Due tonight :( 3-A Star Corporation purchased a machine on January 1, 2011, for $25,000. Before the machine was

Need hep completing this journal enttry. Due tonight :(

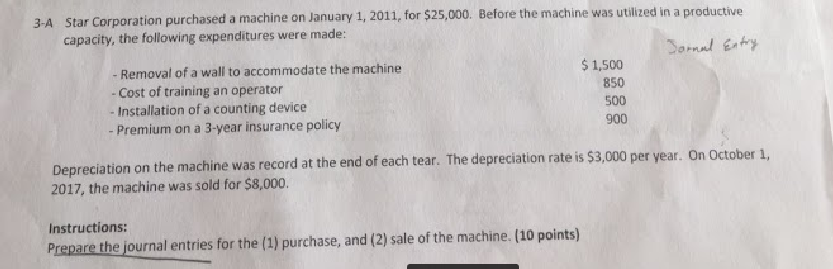

3-A Star Corporation purchased a machine on January 1, 2011, for $25,000. Before the machine was utilized in a productive capacity, the following expenditures were made: - Removal of a wall to accommodate the machine - Cost of training an operator - Installation of a counting device - Premium on a 3-year insurance policy $1,500 850 500 900 Depreciation on the machine was record at the end of each tear. The depreciation rate is $3,000 per year. On October i 2017, the machine was sold for $8,000. Instructions: Prepars the journal entries for the (1) purchase, and (2)sale of the machine. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts