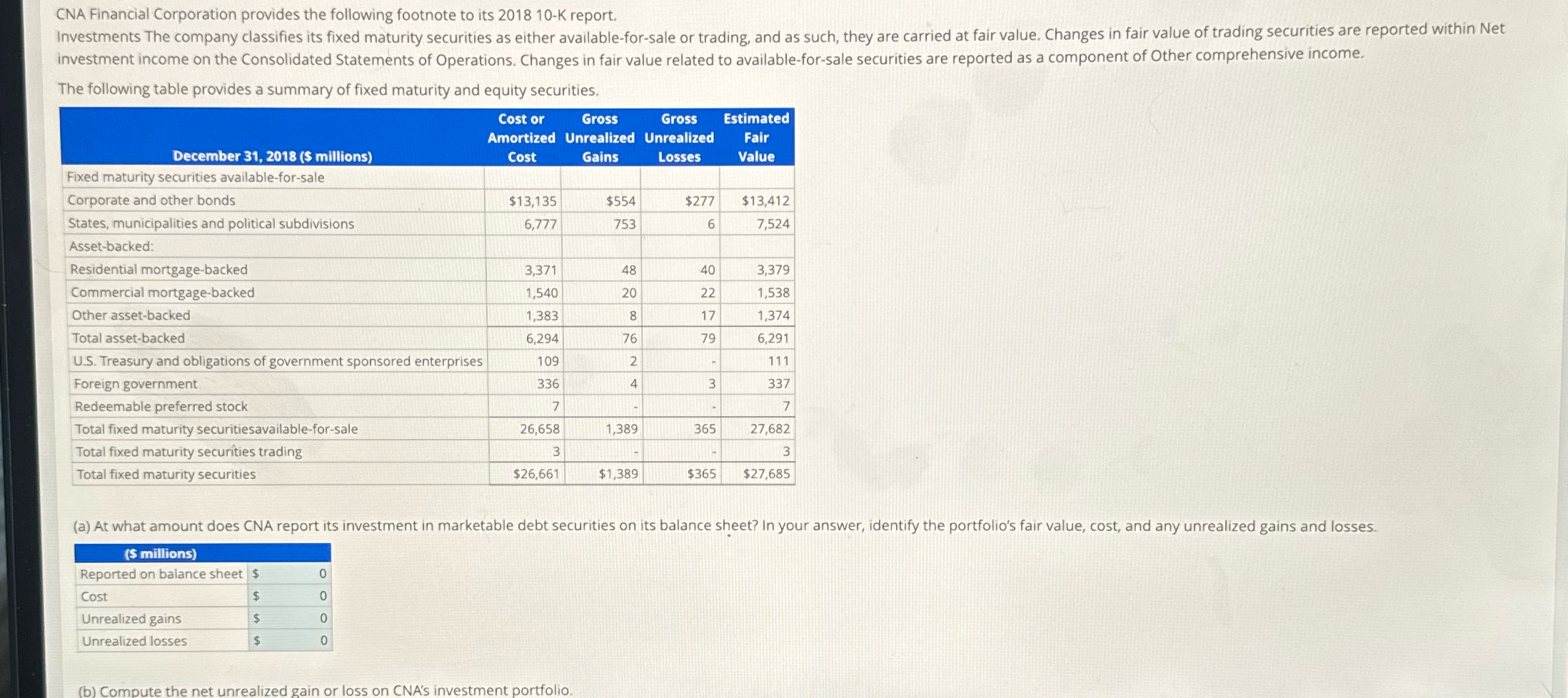

Question: Need hep understanding all partsA: at what amount does CNa report its investment in marketable debt securities on its balance sheet? In your answer identify

Need hep understanding all partsA: at what amount does CNa report its investment in marketable debt securities on its balance sheet? In your answer identify the portfolios fair value, cost, and any unrealized gains and losses. B: compute the net unrealized gain or loss on CNA's investment portfolio. Use a negative sign with your answer to indicate an unrealized loss. Part 2 To B: how do CNA balance sheet and income statement reflect this net unrealized gain or loss (ANSWER CHOICES: securities are reported at historical cost Gains and losses are recognized upon sale of the securities, securities are reported at fair value unrealized gains, and losses are recognized currently in net income, securities are reported at fair value unrealized gains, and losses on AFS securities are recorded and accumulated other comprehensive income, securities are reported unrealized losses are recognized in net income unrealized gains are deferred and recognized upon sale of the securities). C: how do CNA's balance sheet income statement reflect gains and losses realized from the sale of available for sale securities (ANSWER CHOICES:?gains and losses realized from the sale of securities are recognized in current income the company records an accounting reclassification adjustment in the AOCI account to reflect the elimination of previously recorded unrealized gains or losses, no entry is required as the securities are currently reported at fair value and all unrealized gains or losses are reflected in current income the fair value changes bypass the income statement, gains and losses realized from the sale of securities are recognized in current income the company records and accounting reclassification adjustment in cash and cash equivalents to reflect the elimination of previously recorded unrealized gains and losses, gains and losses realized from the sale of securities are recognized in current income the company records an accounting reclassification adjustment in retained earnings to reflect the elimination of previously recorded unrealized gains and losses)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts