Question: NEED IN 10 MINS PLZ ANSWER. WILL RATE GOOD IF SO! Fesla's risk is high, but management is hoping that the sale of some of

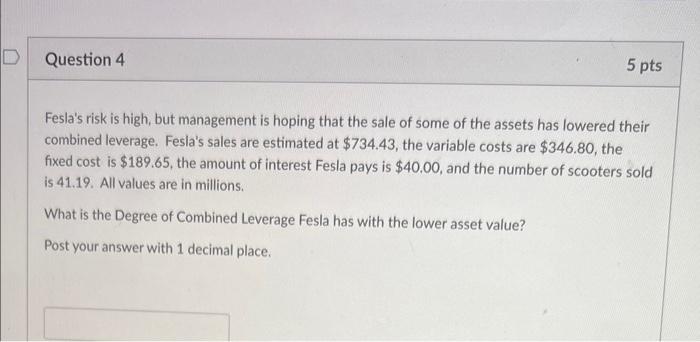

Fesla's risk is high, but management is hoping that the sale of some of the assets has lowered their combined leverage. Fesla's sales are estimated at $734.43, the variable costs are $346.80, the fixed cost is $189.65, the amount of interest Fesla pays is $40.00, and the number of scooters sold is 41.19. All values are in millions. What is the Degree of Combined Leverage Fesla has with the lower asset value? Post your answer with 1 decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts