Question: need it asap plzzz Using the appropriate interest table, compute the present values of the following periodic amounts due at the end of the designated

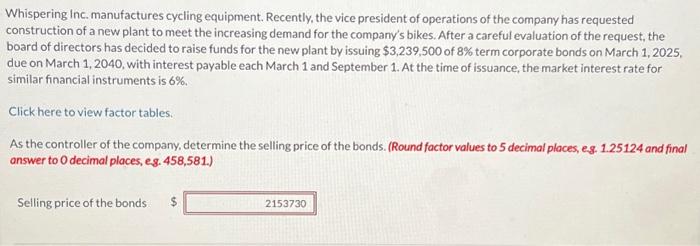

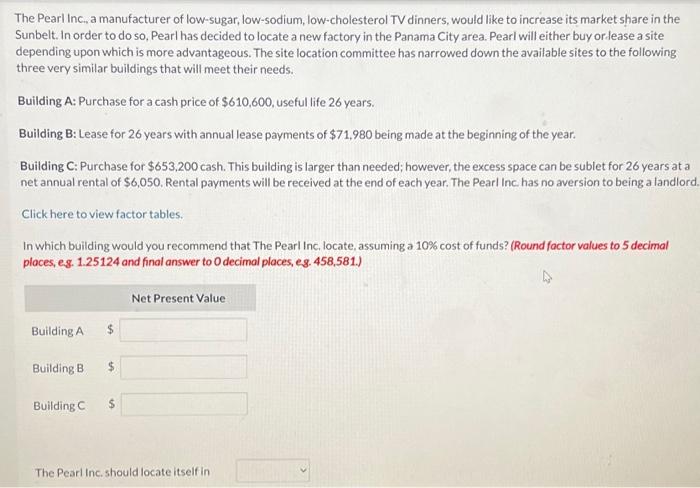

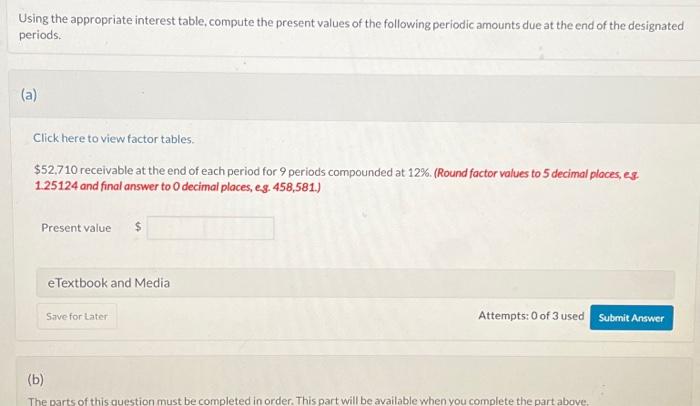

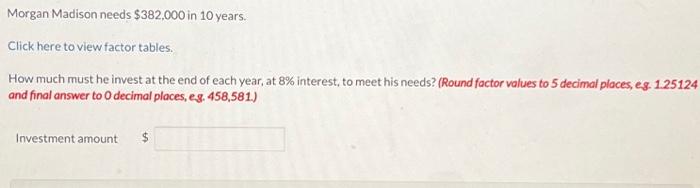

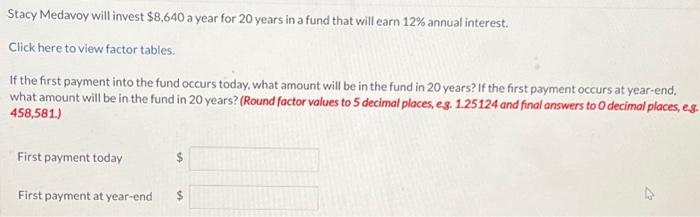

Using the appropriate interest table, compute the present values of the following periodic amounts due at the end of the designated periods. (a) Click here to view factor tables. $52,710 receivable at the end of each period for 9 periods compounded at 12%. (Round factor values to 5 decimal ploces, es. 1.25124 and final answer to 0 decimal places, es. 458,581.) Present value eTextbook and Media Attempts: 0 of 3 used (b) Whispering Inc. manufactures cycling equipment. Recently, the vice president of operations of the company has requested construction of a new plant to meet the increasing demand for the company's bikes. After a careful evaluation of the request, the board of directors has decided to raise funds for the new plant by issuing $3,239,500 of 8% term corporate bonds on March 1,2025, due on March 1,2040, with interest payable each March 1 and September 1. At the time of issuance, the market interest rate for similar financial instruments is 6%. Click here to view factor tables. As the controller of the company, determine the selling price of the bonds. (Round factor values to 5 decimal places, es. 1.25124 and final answer to 0 decimal places, e. .458,581. Selling price of the bonds $ Morgan Madison needs $382,000 in 10 years. Click here to view factor tables. How much must he invest at the end of each year, at 8% interest, to meet his needs? (Round factor values to 5 decimal places, eg. 1.25124 and final answer to 0 decimal places, es. 458,581) Investment amount The Pearl Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Pearl has decided to locate a new factory in the Panama City area. Pearl will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs. Building A: Purchase for a cash price of $610,600, useful life 26 years. Building B: Lease for 26 years with annual lease payments of $71,980 being made at the beginning of the year. Building C: Purchase for $653,200 cash. This building is larger than needed; however, the excess space can be sublet for 26 years at a net annual rental of $6,050. Rental payments will be received at the end of each year. The Pearl Inc. has no aversion to being a landlord. Click here to view factor tables. In which building would you recommend that The Pearl Inc, locate, assuming a 10\% cost of funds? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, es. 458,581.) The Pearl Inc. should locate itself in Stacy Medavoy will invest $8,640 a year for 20 years in a fund that will earn 12% annual interest. Click here to view factor tables. If the first payment into the fund occurs today, what amount will be in the fund in 20 years? If the first payment occurs at year-end. what amount will be in the fund in 20 years? (Round factor values to 5 decimal places, es. 1.25124 and final answers to 0 decimal places, es. 458,581.) First payment today First payment at year-end

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts