Question: Need math work. not written. 8. L0.1, 2, 3 Allie forms Broadbill Corporation by transferring land (basis of $125,000, fair market value of $775,000 ),

Need math work. not written.

Need math work. not written.

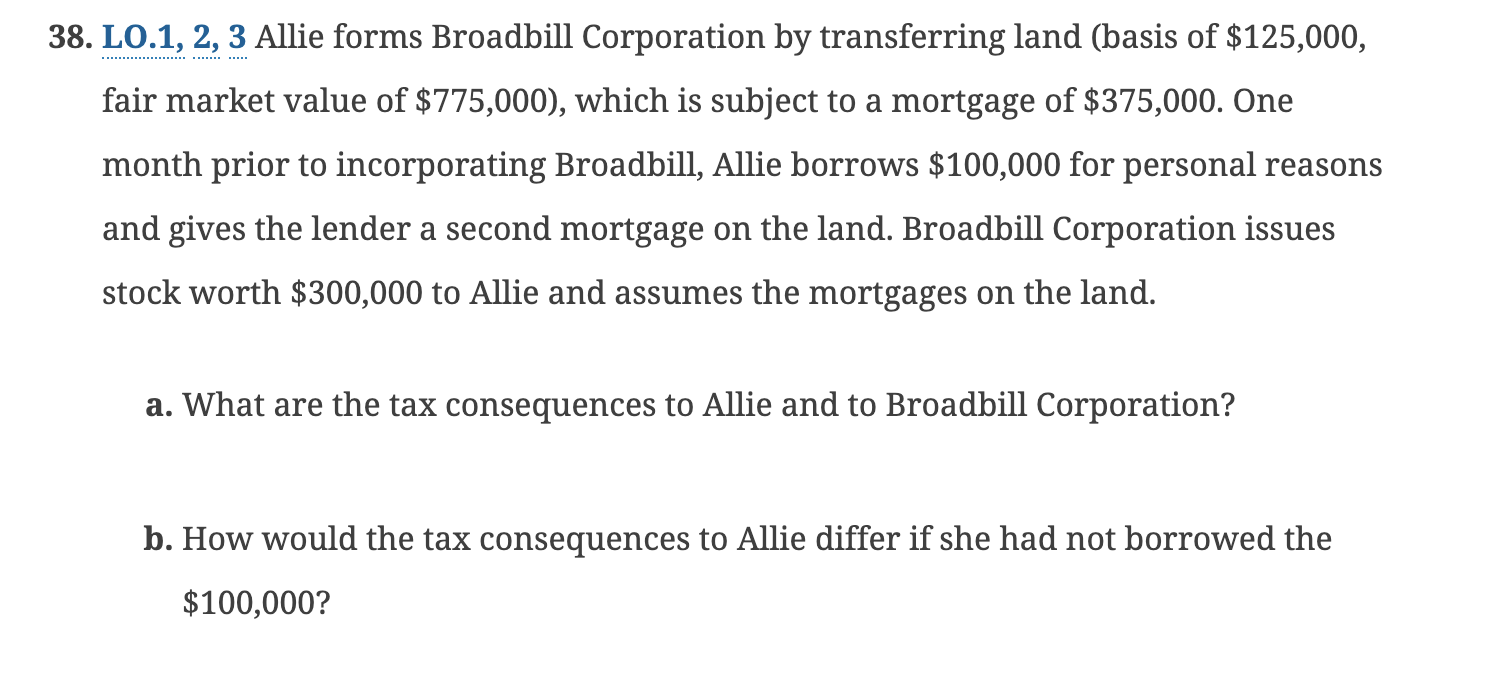

8. L0.1, 2, 3 Allie forms Broadbill Corporation by transferring land (basis of $125,000, fair market value of $775,000 ), which is subject to a mortgage of $375,000. One month prior to incorporating Broadbill, Allie borrows $100,000 for personal reasons and gives the lender a second mortgage on the land. Broadbill Corporation issues stock worth $300,000 to Allie and assumes the mortgages on the land. a. What are the tax consequences to Allie and to Broadbill Corporation? b. How would the tax consequences to Allie differ if she had not borrowed the $100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts