Question: need only answer of 23-9 question. Please do answer by typing so that I can copy it. 170,000 180,000 amount that Hiland Airways should pay

need only answer of 23-9 question. Please do answer by typing so that I can copy it.

need only answer of 23-9 question. Please do answer by typing so that I can copy it.

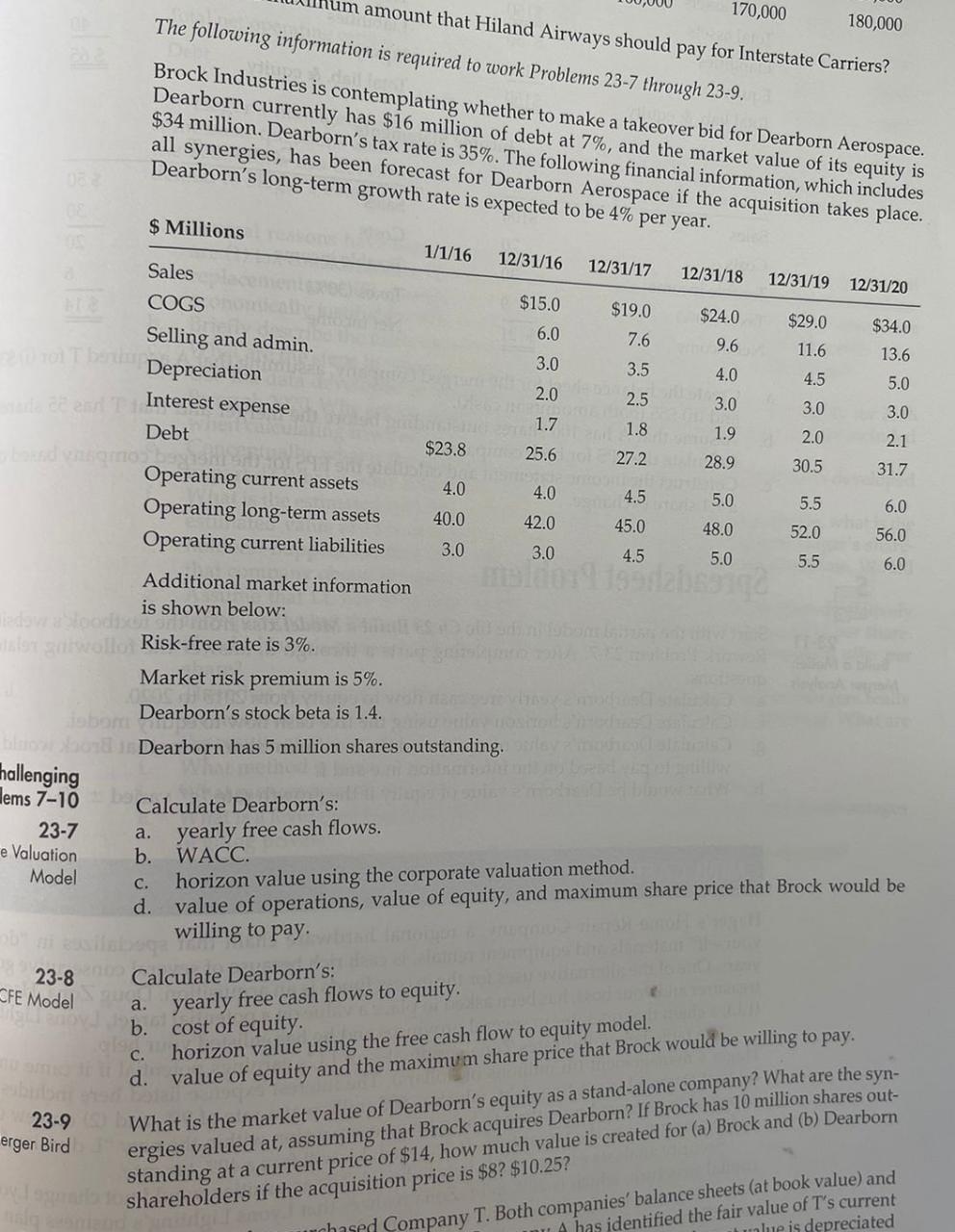

170,000 180,000 amount that Hiland Airways should pay for Interstate Carriers? The following information is required to work Problems 23-7 through 23-9. Brock Industries is contemplating whether to make a takeover bid for Dearborn Aerospace. Dearborn currently has $16 million of debt at 7%, and the market value of its equity is $34 million. Dearborn's tax rate is 35%. The following financial information, which includes all synergies, has been forecast for Dearborn Aerospace if the acquisition takes place. Dearborn's long-term growth rate is expected to be 4% per year. $ Millions 1/1/16 12/31/16 12/31/17 12/31/18 12/31/19 13.6 2.0 1.8 4.5 5.0 6.0 Sales 12/31/20 COGS $15.0 $19.0 $24.0 $29.0 $34.0 Selling and admin. 6.0 7.6 9.6 11.6 Depreciation 3.0 3.5 4.0 4.5 5.0 Interest expense 2.5 3.0 3.0 3.0 1.7 Debt 1.9 2.0 2.1 $23.825.627.2 28.9 30.5 31.7 Operating current assets 4.0 4.0 5.5 Operating long-term assets 6.0 40.0 42.0 45.0 48.0 52.0 56.0 Operating current liabilities 3.0 3.0 4.5 5.0 5.5 6.0 Additional market information is shown below: Ecode soll Risk-free rate is 3%. Market risk premium is 5%. Dearborn's stock beta is 1.4. Dearborn has 5 million shares outstanding. hallenging Hems 7-10 Calculate Dearborn's: 23-7 yearly free cash flows. e Valuation b. WACC. Model C. horizon value using the corporate valuation method. d. value of operations, value of equity, and maximum share price that Brock would be willing to pay 23-8 Calculate Dearborn's: a yearly free cash flows to equity. b. cost of equity. c. horizon value using the free cash flow to equity model. d. value of equity and the maximum share price that Brock would be willing to pay. 23-9 What is the market value of Dearborn's equity as a stand-alone company? What are the syn- erger Bird a. OFE Model ergies valued at, assuming that Brock acquires Dearborn? If Brock has 10 million shares out- standing at a current price of $14, how much value is created for (a) Brock and (b) Dearborn shareholders if the acquisition price is $8? $10.25? urchased Company T. Both companies' balance sheets (at book value) and A has identified the fair value of T's current ibulue is depreciated 170,000 180,000 amount that Hiland Airways should pay for Interstate Carriers? The following information is required to work Problems 23-7 through 23-9. Brock Industries is contemplating whether to make a takeover bid for Dearborn Aerospace. Dearborn currently has $16 million of debt at 7%, and the market value of its equity is $34 million. Dearborn's tax rate is 35%. The following financial information, which includes all synergies, has been forecast for Dearborn Aerospace if the acquisition takes place. Dearborn's long-term growth rate is expected to be 4% per year. $ Millions 1/1/16 12/31/16 12/31/17 12/31/18 12/31/19 13.6 2.0 1.8 4.5 5.0 6.0 Sales 12/31/20 COGS $15.0 $19.0 $24.0 $29.0 $34.0 Selling and admin. 6.0 7.6 9.6 11.6 Depreciation 3.0 3.5 4.0 4.5 5.0 Interest expense 2.5 3.0 3.0 3.0 1.7 Debt 1.9 2.0 2.1 $23.825.627.2 28.9 30.5 31.7 Operating current assets 4.0 4.0 5.5 Operating long-term assets 6.0 40.0 42.0 45.0 48.0 52.0 56.0 Operating current liabilities 3.0 3.0 4.5 5.0 5.5 6.0 Additional market information is shown below: Ecode soll Risk-free rate is 3%. Market risk premium is 5%. Dearborn's stock beta is 1.4. Dearborn has 5 million shares outstanding. hallenging Hems 7-10 Calculate Dearborn's: 23-7 yearly free cash flows. e Valuation b. WACC. Model C. horizon value using the corporate valuation method. d. value of operations, value of equity, and maximum share price that Brock would be willing to pay 23-8 Calculate Dearborn's: a yearly free cash flows to equity. b. cost of equity. c. horizon value using the free cash flow to equity model. d. value of equity and the maximum share price that Brock would be willing to pay. 23-9 What is the market value of Dearborn's equity as a stand-alone company? What are the syn- erger Bird a. OFE Model ergies valued at, assuming that Brock acquires Dearborn? If Brock has 10 million shares out- standing at a current price of $14, how much value is created for (a) Brock and (b) Dearborn shareholders if the acquisition price is $8? $10.25? urchased Company T. Both companies' balance sheets (at book value) and A has identified the fair value of T's current ibulue is depreciated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts