Question: Need part (c) with work shown please PART B: CALCULATION (KEEP FOUR DECIMAL PLACES FOR ALL YOUR ANSWERS) I. You are given the following benchmark

Need part (c) with work shown please

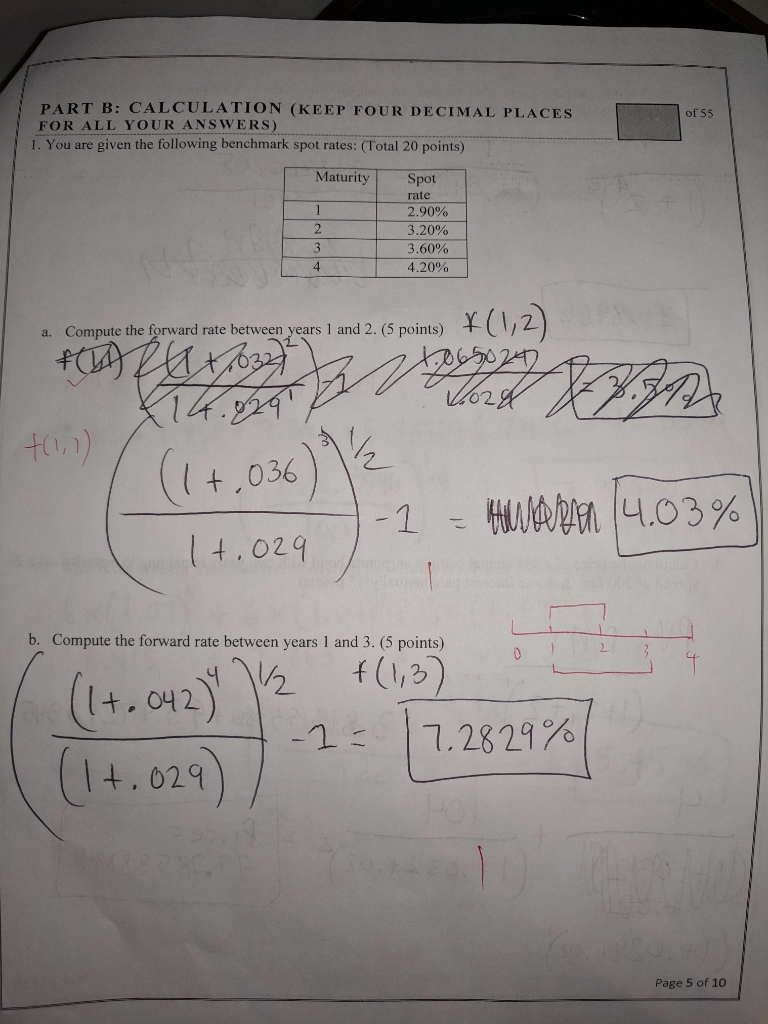

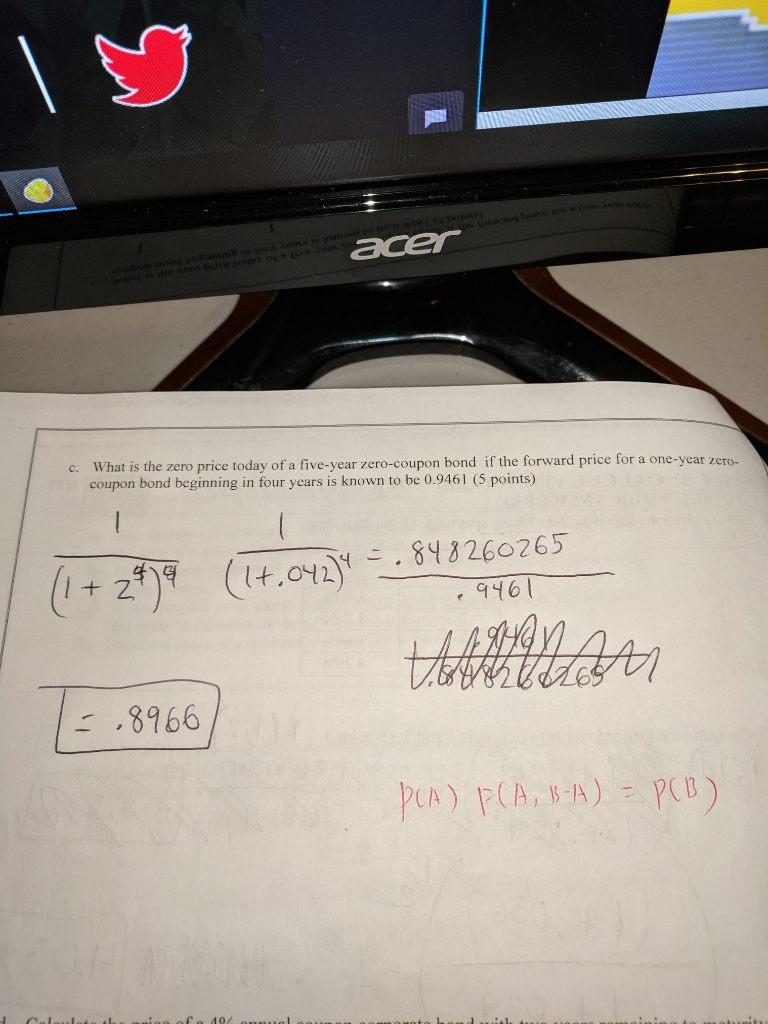

PART B: CALCULATION (KEEP FOUR DECIMAL PLACES FOR ALL YOUR ANSWERS) I. You are given the following benchmark spot rates: (Total 20 of 55 points) Maturity Spot rate 2.90% 3.20% 3.60% 4.20% 4 (12) a. Compute the forward rate between years 1 and 2.(5 points) ,036)2 -1 A 14,03 % l 4. 029 b. Compute the forward rate between years I and 3. (5 points) +. 042 1: 17.28 29 % ( 14.034) Page 5 of 10 What is the zero price today of a five-year zero-coupon bond if the forward price for a one-ycar zero- coupon bond beginning in four years is known to be 0.9461 (5 points) c. + 2 946 8966

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts