Question: Need Python code for Part 2 Part 2 - Pay Calculator Sample Output: Pay Check Calculator Hours Worked: 35 Hourly Pay Rate: 14.50 Gross Pay:

Need Python code for Part 2

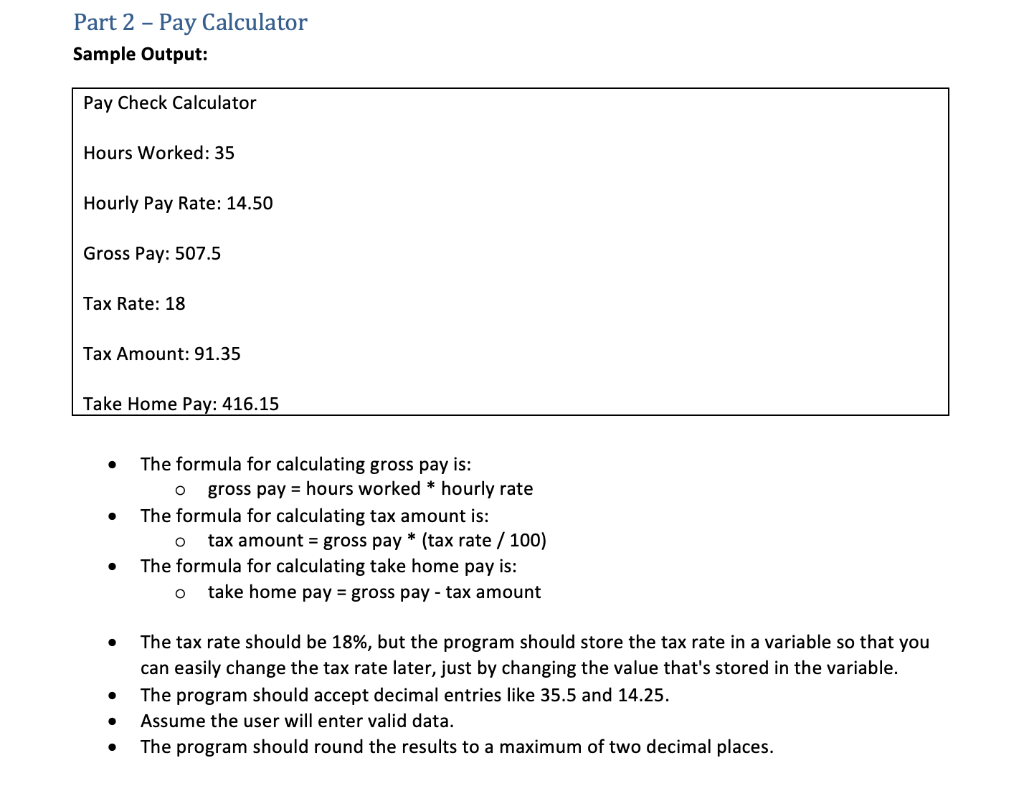

Part 2 - Pay Calculator Sample Output: Pay Check Calculator Hours Worked: 35 Hourly Pay Rate: 14.50 Gross Pay: 507.5 Tax Rate: 18 Tax Amount: 91.35 Take Home Pay: 416.15 The formula for calculating gross pay is: o gross pay = hours worked * hourly rate The formula for calculating tax amount is: o tax amount = gross pay * (tax rate / 100) The formula for calculating take home pay is: o take home pay = gross pay-tax amount The tax rate should be 18%, but the program should store the tax rate in a variable so that you can easily change the tax rate later, just by changing the value that's stored in the variable. The program should accept decimal entries like 35.5 and 14.25. Assume the user will enter valid data. The program should round the results to a maximum of two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts