Question: NEED QUESTION ANSWERED ASAP: Can Mit delay taking minimum distributions from his Big Company Plan since he is still employed? Explain why or why not.

NEED QUESTION ANSWERED ASAP: Can Mit delay taking minimum distributions from his Big Company Plan since he is still employed? Explain why or why not.

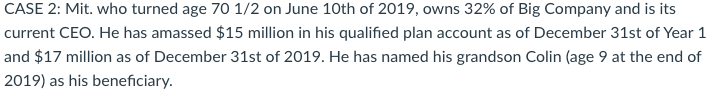

CASE 2: Mit. who turned age 70 1/2 on June 10th of 2019, owns 32% of Big Company and is its current CEO. He has amassed $15 million in his qualified plan account as of December 31st of Year 1 and $17 million as of December 31st of 2019. He has named his grandson Colin (age 9 at the end of 2019) as his beneficiary. CASE 2: Mit. who turned age 70 1/2 on June 10th of 2019, owns 32% of Big Company and is its current CEO. He has amassed $15 million in his qualified plan account as of December 31st of Year 1 and $17 million as of December 31st of 2019. He has named his grandson Colin (age 9 at the end of 2019) as his beneficiary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts