Question: need quickly, will like!!! QUESTION 23 Imagine a scenario where Amazon and Walmart compose the entire e-commerce industry. The companies have two strategic choices: keep

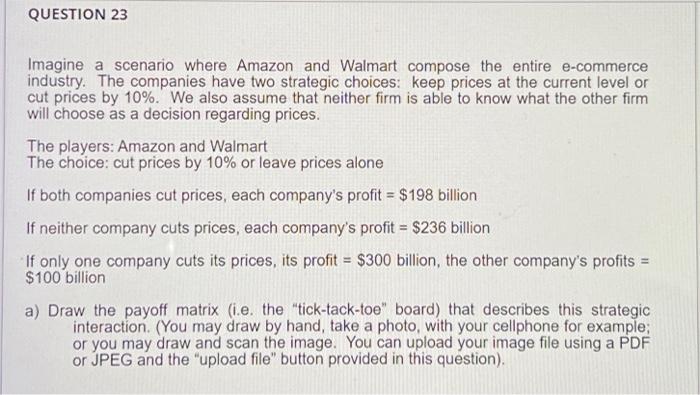

QUESTION 23 Imagine a scenario where Amazon and Walmart compose the entire e-commerce industry. The companies have two strategic choices: keep prices at the current level or cut prices by 10%. We also assume that neither firm is able to know what the other firm will choose as a decision regarding prices. The players: Amazon and Walmart The choice: cut prices by 10% or leave prices alone If both companies cut prices, each company's profit = $198 billion If neither company cuts prices, each company's profit = $236 billion If only one company cuts its prices, its profit = $300 billion, the other company's profits = $100 billion a) Draw the payoff matrix (i.e. the "tick-tack-toe" board) that describes this strategic interaction. (You may draw by hand, take a photo with your cellphone for example; or you may draw and scan the image. You can upload your image file using a PDF or JPEG and the "upload file" button provided in this question). b) What is the most likely outcome that will occur if both companies follow the outcome that leads to their highest payoff without knowing what the other company is doing (i.e. this is called the Nash equilibrium)? Attach File Browse Local Files Browse Content Collection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts