Question: need quickly, will like!!! The following table summarizes the yields to maturity on several one-year, zero-coupon securities a. What is the price (expressed as a

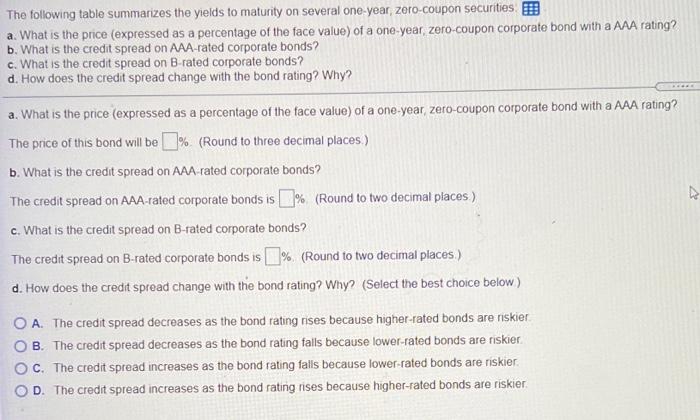

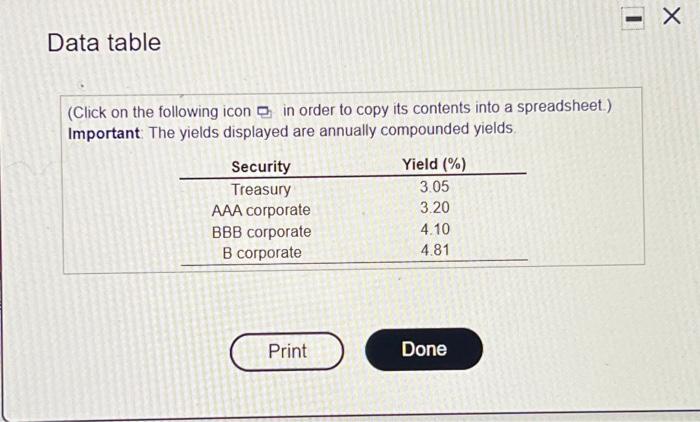

The following table summarizes the yields to maturity on several one-year, zero-coupon securities a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? b. What is the credit spread on AAA-rated corporate bonds? c. What is the credit spread on B-rated corporate bonds? d. How does the credit spread change with the bond rating? Why? a. What is the price (expressed as a percentage of the face value) of a one-year zero-coupon corporate bond with a AAA rating? The price of this bond will be % (Round to three decimal places) b. What is the credit spread on AAA-rated corporate bonds? The credit spread on AAA-rated corporate bonds is % (Round to two decimal places ) c. What is the credit spread on B-rated corporate bonds? The credit spread on B-rated corporate bonds is 1% (Round to two decimal places) d. How does the credit spread change with the bond rating? Why? (Select the best choice below) w tra OA. The credit spread decreases as the bond rating nises because higher-rated bonds are riskier B. The credit spread decreases as the bond rating falls because lower-rated bonds are riskier C. The credit spread increases as the bond rating falls because lower-rated bonds are riskier. D. The credit spread increases as the bond rating rises because higher-rated bonds are riskier Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Important The yields displayed are annually compounded yields Security Treasury AAA corporate BBB corporate B corporate Yield (%) 3.05 3.20 4.10 4.81 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts