Question: need Right answer I will provide you feedback thanks Question 6 Aaron started his own business on 1 September 2014 providing translation services mostly to

need Right answer I will provide you feedback thanks

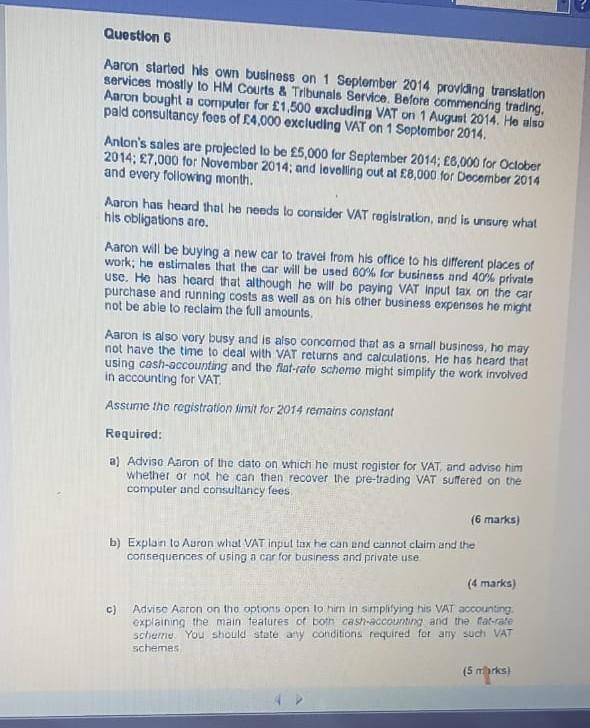

Question 6 Aaron started his own business on 1 September 2014 providing translation services mostly to HM Courts & Tribunals Service. Before commending trading, Aaron bought a compular for 1,500 excluding VAT on 1 August 2014. He also pald consultancy fees of 4,000 excluding VAT on 1 September 2014 Anlon's sales are projected to be 5,000 for September 2014; 8,000 for October 2014: 7,000 for Novombor 2014; and lovelling out at 8,000 for December 2014 and every following month. Aaron has heard that he needs lo consider VAT registration, and is unsure what his obligations are Aaron will be buying a new car to travel from his office to his different places of work, he estimates that the car will be used 60% for business and 40% privalo use. He has heard that although he will be paying VAT input tax on the car purchase and running costs as well as on his other business expenses he might not be able to reclaim the full amounts Aaron is also very busy and is also concomod that as a small business, ho may not have the time to deal with VAT returns and calculations. He has heard that using cash-accounting and the flat-rate schomo might simplify the work involved in accounting for VAT Assume the registration forut for 2014 remains constant Required: a) Adviso Aaron of the dato on which he must rogister for VAT, and adviso him whether or not he can then recover the pre-trading VAT suffered on the computer and consultancy fees (6 marks) b) Explan to Auron what VAT input tox he can und cannot claim and the consequences of using a car for business and private use (4 marks) c) Advise Aaron on the options open to him in simplifying his VAT accounting explaining the main features of both cash-accounting and the fat-rate scheme. You should state any conditions required for any such VAT schemes (5 marksStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock