Question: need right answer please don't copy Other Points (1) Deduction ws BOC shall be allowed even if investment is made in these savings scheme of

need right answer please don't copy

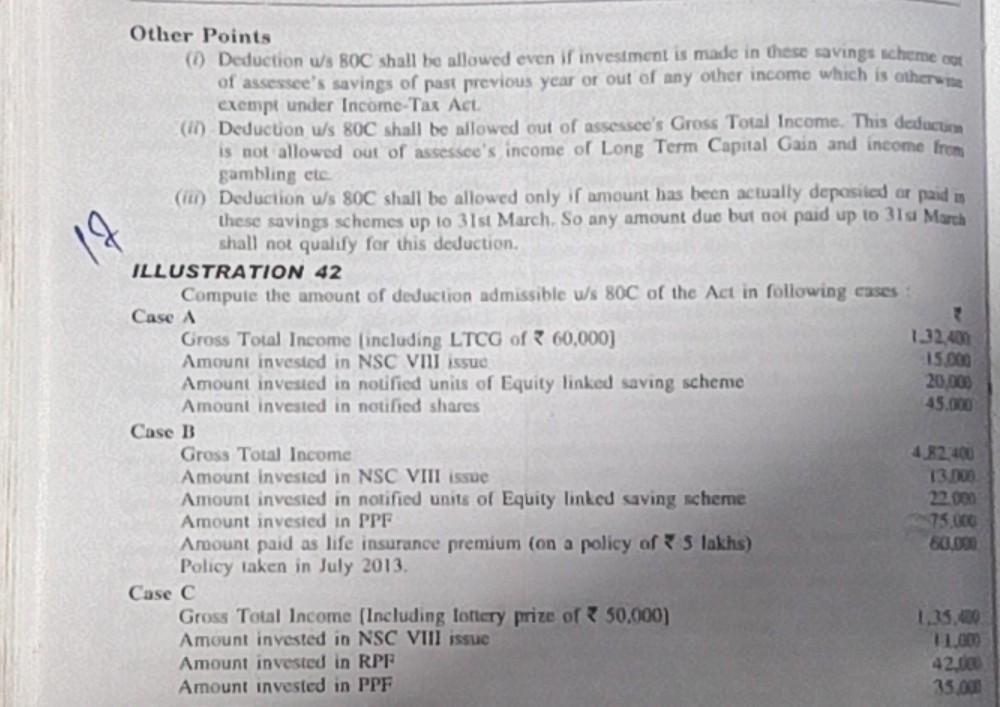

Other Points (1) Deduction ws BOC shall be allowed even if investment is made in these savings scheme of assessee's savings of past previous year or out of any other income which is otherwise cxempt under Income Tax Act. (in) Deduction w's 80C shall be allowed out of assessee's Gross Total Income. This deduction is not allowed out of assessce's income of Long Term Capital Gain and income from gambling cte (II) Deduction ws 80C shall be allowed only if amount has been actually deposited or paid in these savings schemes up to 31st March. So any amount due but not paid up to 31s March shall not qualify for this deduction ILLUSTRATION 42 Compute the amount of deduction admissible us 80C of the Act in following cases Case A Gross Total Income (including LTCG of 60,000) 132,400 Amount invested in NSC vni issue Amount invested in notified units of Equity linked saving scheme 20.000 Amount invested in notified shares 45.000 Case B Gross Total Income 4.82 100 Amount invested in NSC VIII issue 13 000 Amount invested in notified units of Equity linked saving scheme Amount invested in PPF 75.000 Amount paid as life insurance premium (on a policy of 5 lakhs) 80.00 Policy taken in July 2013 Case C Gross Total Income (Including lottery prize of 50.000) 1.35.00 Amount invested in NSC VIII issue 11.00 Amount invested in RPF 42.00 Amount invested in PPF 35.000 15.000Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock