Question: need right answer PROBLEM / of Aamira is a widow has two children Himayat and Nihada Himayat has completed his graduation and Nihada is in

need right answer

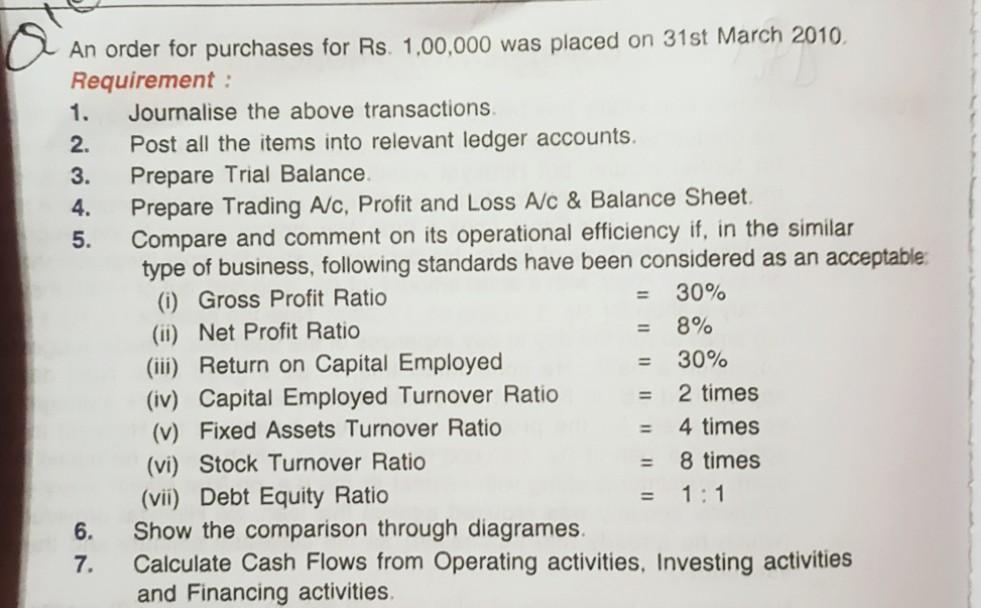

PROBLEM / of Aamira is a widow has two children Himayat and Nihada Himayat has completed his graduation and Nihada is in the first year of B.Com Aamira wants Himayat to go for further studies but Himayat wants to become a businessman and help her mother. Himayat wants to start a readymade shirts business under the trade name M/s Fancy Look & Bros. Her mother agrees to the proposal but the problem is shortage of funds. He decided to start the sole proprietorship business on 1st April 2009, with a small amount of Rs. 5,00,000 out of which they managed to buy a shop for Rs. 3,50,000 on 15 2009 Now the balance i.e. Rs 1,50.000 was too small to run the day to day expenses of the business, Nihada suggested him to approach a bank. He considered this to be a good idea Next day Himayat approached SBI to find out the possibilities of loan The bank manager asked for some papers for the proposal which were submitted by Himayat in time SBI approved a loan of Rs. 4,50.000 on 1.10.2009, which was to be repaid in 10 equal yearly instalments along with interest @ 5% p.a on 31st March every year Some collateral security was required against this loan. So Himayat provided the shop (which he already had purchased) as the collateral security and the loan was sanctioned He opened a bank account with Rs 1,50.000 on 18 2009 SBI credited his bank account with the amount of loan on 110 2009 On 1.10.2009, he purchased a computer for the use of business at Rs 40,000, the payment was made through cheque. He entered into a contract with a distributor of shirts. The distributor required 25% of the total order be given as advance and 75% be paid on delivery. All payments were to be made through cheque and all receipts on account of sales were to be deposited into bank. During festival season, he renovated the shop and purchased furniture for Rs 2,00.000 on 31.12.2009 He also distributed gifts of Rs 10.000. His transactions for the year ending 31 March 2010 were as follows Rs Total Purchases 16,80,000 Total Sales 20.40,000 10,000 Carriage Inward 1.20,000 Salary to Manager (10,000 p.m.) 1.20,000 Salary to the Staff (@ Rs. 5,000 p.m. for 12 months to two employees) 25,000 Telephone Expenses 15.000 Electricity Charges 48,000 Packing Expenses 6,000 Printing & Stationery 60,000 Accounting Expenses 45,000 Advertising 15,000 Bank Charges Insurance Premium 16,000 Staff Welfare Expenses 5,750 Conveyance At the end of the year, the installments of loan along with interest was duly paid to SBI. 5.000 Closing stock valuing Rs 4,00,000 was lying on 31 3 2010 Himayat decided to depreciate computers @ 20% p.a. and Furniture @ 10% p.a. He also made drawings of Rs. 5,000 p.m from bank. An order for purchases for Rs. 1,00,000 was placed on 31st March 2010 Requirement : 1. Journalise the above transactions 2. Post all the items into relevant ledger accounts. 3. Prepare Trial Balance. 4. Prepare Trading A/c, Profit and Loss A/C & Balance Sheet. 5. Compare and comment on its operational efficiency if, in the similar type of business, following standards have been considered as an acceptable (i) Gross Profit Ratio 30% (ii) Net Profit Ratio 8% (iii) Return on Capital Employed 30% (iv) Capital Employed Turnover Ratio 2 times (v) Fixed Assets Turnover Ratio 4 times (vi) Stock Turnover Ratio 8 times (vii) Debt Equity Ratio 1:1 6. Show the comparison through diagrames 7. Calculate Cash Flows from Operating activities, Investing activities and Financing activities =Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock