Question: need right answer TAX LAWS AND PRACTICE ( he may calculate the exemption as 54F for each asset separately and then compare the me beneficial

need right answer

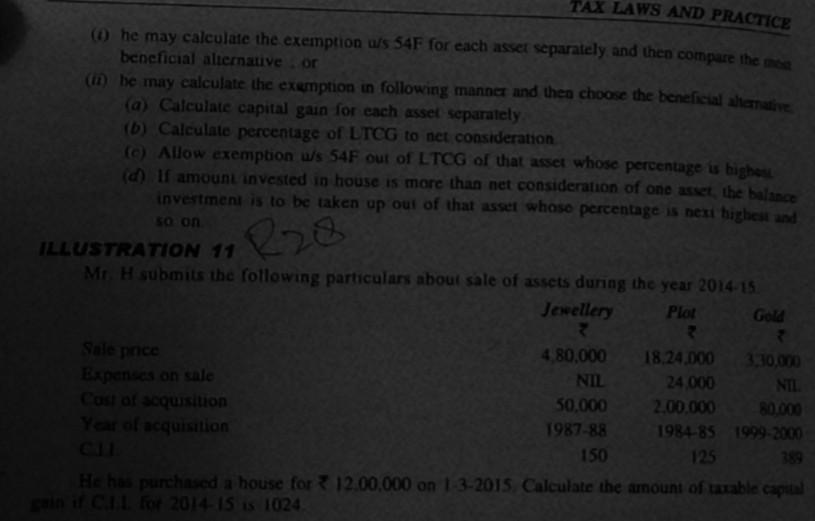

TAX LAWS AND PRACTICE ( he may calculate the exemption as 54F for each asset separately and then compare the me beneficial alternative or (m) he may calculate the exemption in following manner and then choose the beneficial alternative (a) Calculate capital gain for each asset separately (b) Calculate percentage of LTCG to net consideration (c) Allow exemption ws 54F out of LTCG of that asset whose percentage is bighest (d) If amount invested in house is more than net consideration of one aset the balance investment is to be taken up out of that asset whose percentage is next highest and so on ILLUSTRATION 11 M. H submits the following particulars about sale of assets during the year 2014-15 Jewellery Plot Gold Sale price 480,000 18,24 DOO 330.000 Expenses on sale NIL 24 000 NIL Cost of acquisition 50,000 2.00.000 80.000 Year of acquisition 1987-88 1984-85 1999-2000 150 125 389 He has purchased a house for ? 12.00,000 on 13-2015. Calculate the arount of taxable capital ini Cel for 2014-15 is 1024Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock