Question: need serious help please . put formula text please Use the Project-2 Template file to complete the following questions. Q1. A stock selling for $25

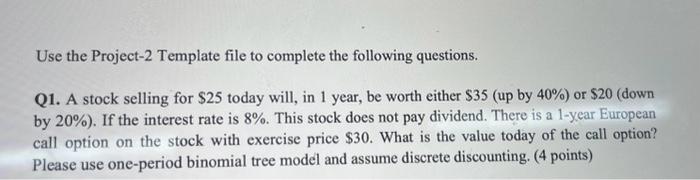

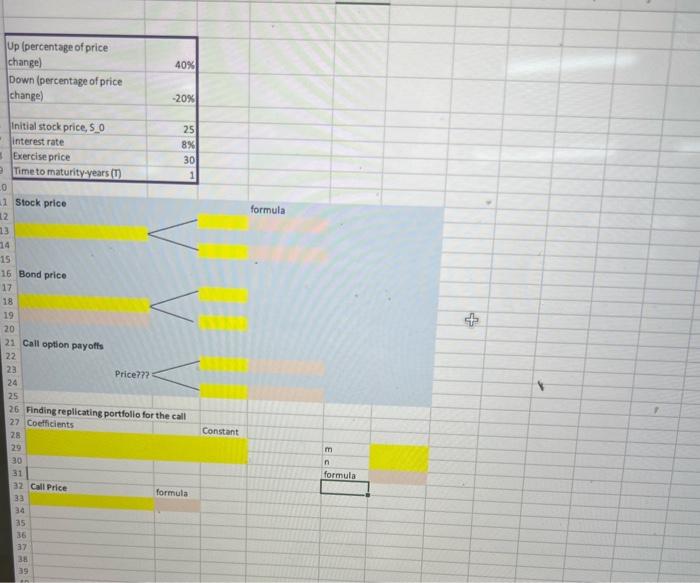

Use the Project-2 Template file to complete the following questions. Q1. A stock selling for $25 today will, in 1 year, be worth either $35 (up by 40% ) or $20 (down by 20% ). If the interest rate is 8%. This stock does not pay dividend. There is a 1-year European call option on the stock with exercise price $30. What is the value today of the call option? Please use one-period binomial tree model and assume discrete discounting. (4 points) Stock price formula Bond price Call option payoffs Finding replicating portfollo for the call Coefficients Constant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts