Question: need serious help please Q2. Suppose there is also a 1-year European put option on the same stock as in Question 2 with exercise price

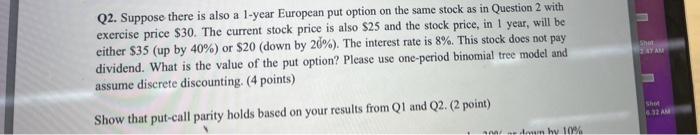

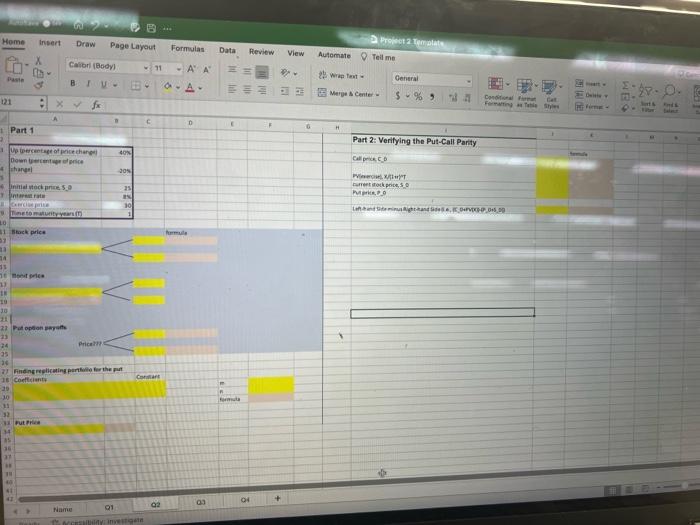

Q2. Suppose there is also a 1-year European put option on the same stock as in Question 2 with exercise price $30. The current stock price is also $25 and the stock price, in 1 year, will be either $35 (up by 40% ) or $20 (down by 20% ). The interest rate is 8%. This stock does not pay dividend. What is the value of the put option? Please use one-period binomial tree model and assume discrete discounting. (4 points) Show that put-call parity holds based on your results from Q1 and Q2. (2 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts