Question: need simple explain please 11) The following figures show the pay-off structure of stock op the expiration date. Circle the correct position (long or short)

need simple explain please

need simple explain please

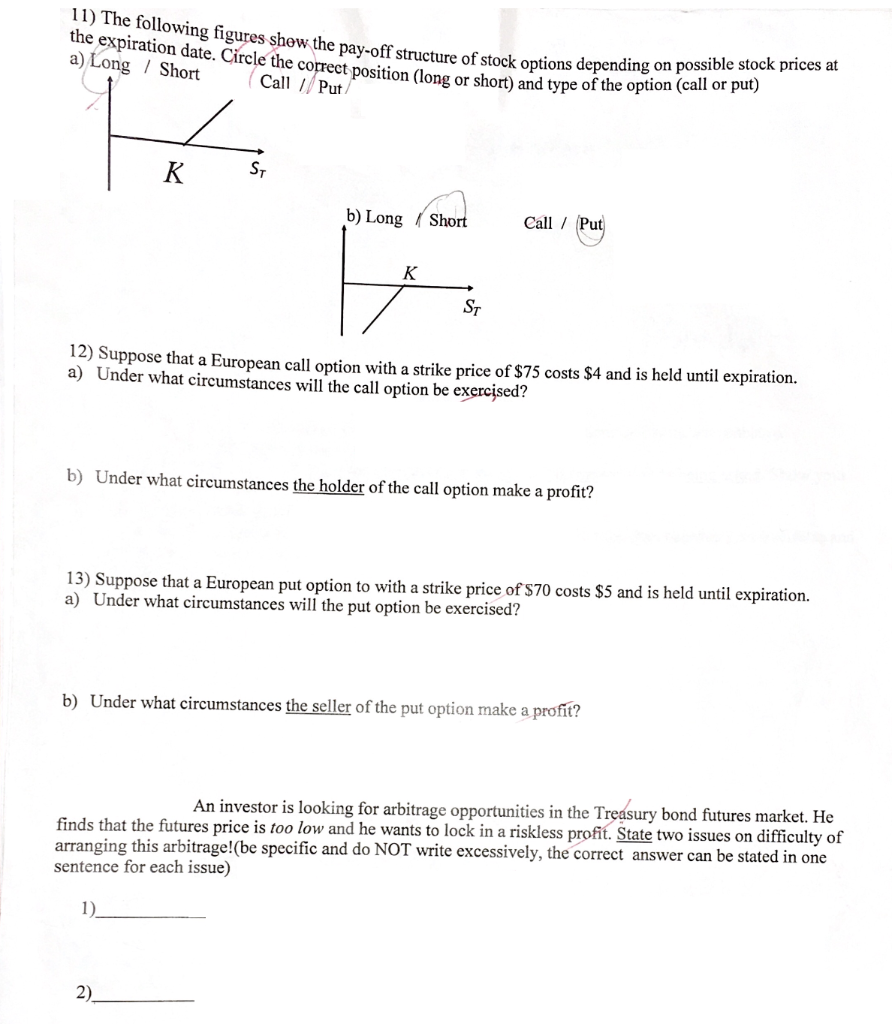

11) The following figures show the pay-off structure of stock op the expiration date. Circle the correct position (long or short) a) Long / Short Call / Put ! structure of stock options depending on possible stock prices at cet position (long or short) and type of the option (call or put) IK S7 b) Long Short Call / Put 12) Suppose that a European call option with a strike price of $75 costs $4 and is held until expiration. a) Under what circumstances will the call option be exercised? b) Under what circumstances the holder of the call option make a profit? 13) Suppose that a European put option to with a strike price of $70 costs $5 and is held until expiration. a) Under what circumstances will the put option be exercised? b) Under what circumstances the seller of the put option make a profit? An investor is looking for arbitrage opportunities in the Treasury bond futures market. He finds that the futures price is too low and he wants to lock in a riskless profit. State two issues on difficulty of arranging this arbitrage!(be specific and do NOT write excessively, the correct answer can be stated in one sentence for each issue)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts