Question: need small comparison between the 2 companies' annual report. values are given. and the table to be filled is also given Computation of Ratio Analysis

need small comparison between the 2 companies' annual report. values are given. and the table to be filled is also given

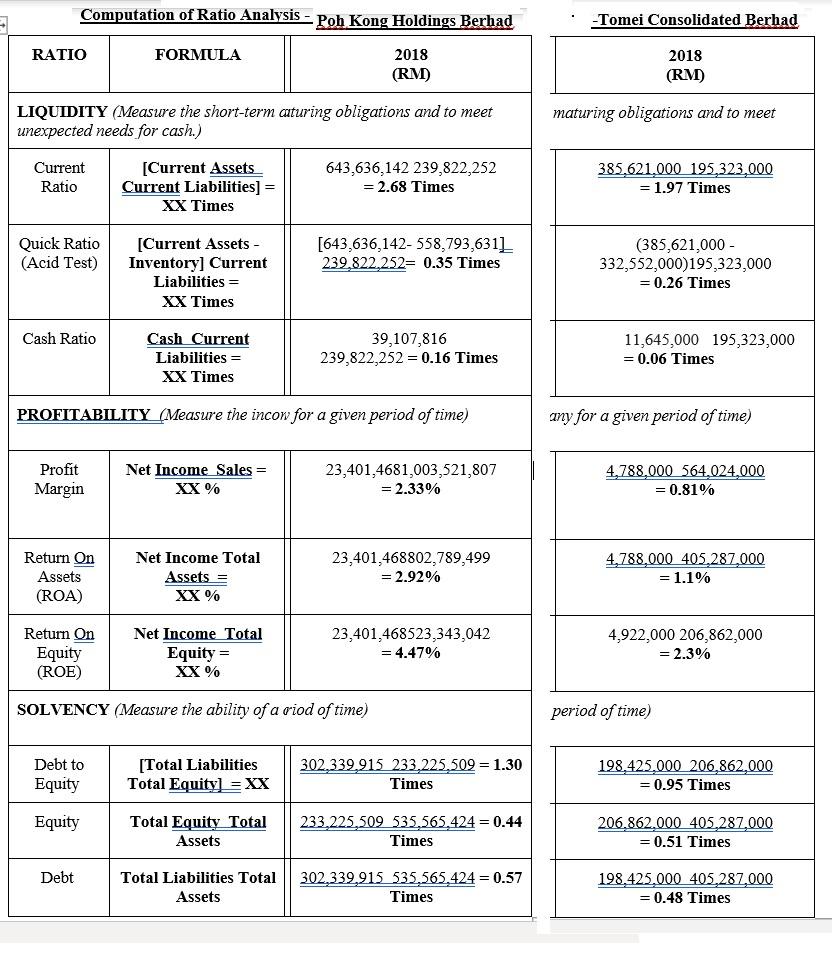

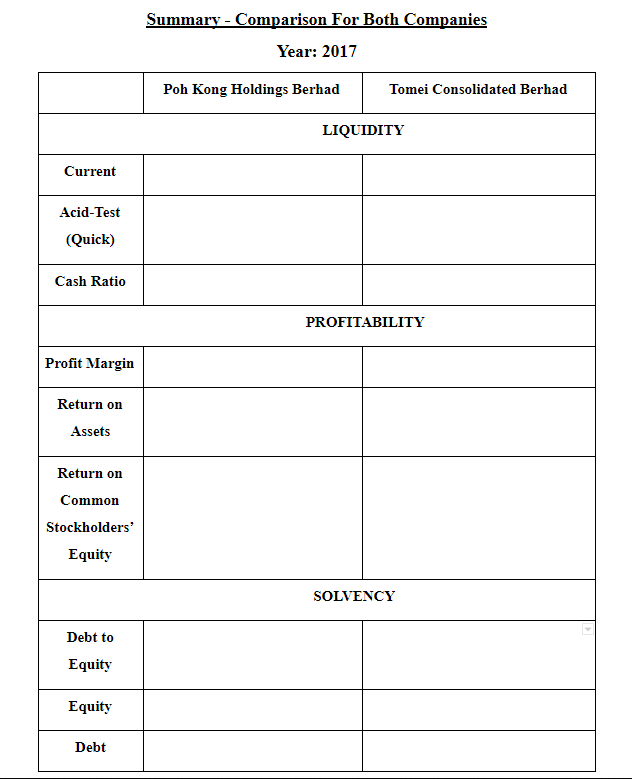

Computation of Ratio Analysis - Poh Kong Holdings Berhad : Tomei Consolidated Berhad RATIO FORMULA 2018 2018 (RM) (RM) LIQUIDITY (Measure the short-term aturing obligations and to meet unexpected needs for cash.) maturing obligations and to meet Current Ratio (Current Assets Current Liabilities] = XX Times 643,636,142 239,822,252 = 2.68 Times 385.621.000 195,323,000 = 1.97 Times Quick Ratio (Acid Test) [643,636,142-558,793,6311 239,822,252= 0.35 Times [Current Assets - Inventory] Current Liabilities = XX Times (385,621,000 - 332,552,000)195,323,000 = 0.26 Times Cash Ratio Cash Current Liabilities = XX Times 39,107,816 239,822,252 = 0.16 Times 11,645,000 195,323,000 = 0.06 Times PROFITABILITY (Measure the incow for a given period of time) any for a given period of time) Profit Margin Net Income Sales = XX % 23,401,4681,003,521,807 = 2.33% 4,788,000 564,024,000 = 0.81% Return On Assets (ROA) Net Income Total Assets = XX% 23,401,468802,789,499 = 2.92% 4,788,000 405,287,000 = 1.1% Return On Equity (ROE) Net Income Total Equity = XX % 23,401,468523,343,042 = 4.47% 4,922,000 206,862,000 = 2.3% SOLVENCY (Measure the ability of a riod of time) period of time) Debt to Equity [Total Liabilities Total Equity) = XX 302,339,915 233,225,509 = 1.30 Times 198.425.000 206,862.000 = 0.95 Times Equity Total Equity Total Assets 233,225,509 535,565,424 = 0.44 Times 206.862.000 405,287,000 = 0.51 Times Debt Deo Total Liabilities Total Assets 302,339,915 535,565,424 = 0.57 Times 198,425.000 405,287,000 = 0.48 Times Summary - Comparison For Both Companies Year: 2017 Poh Kong Holdings Berhad Tomei Consolidated Berhad LIQUIDITY Current Acid-Test (Quick) Cash Ratio PROFITABILITY Profit Margin Return on Assets Return on Common Stockholders' Equity SOLVENCY Debt to Equity Equity Debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts