Question: Need solution for this question but I am getting problem in uploading second question d. The partners agree that the building is worth $682,000 (net).

Need solution for this question but I am getting problem in uploading second question

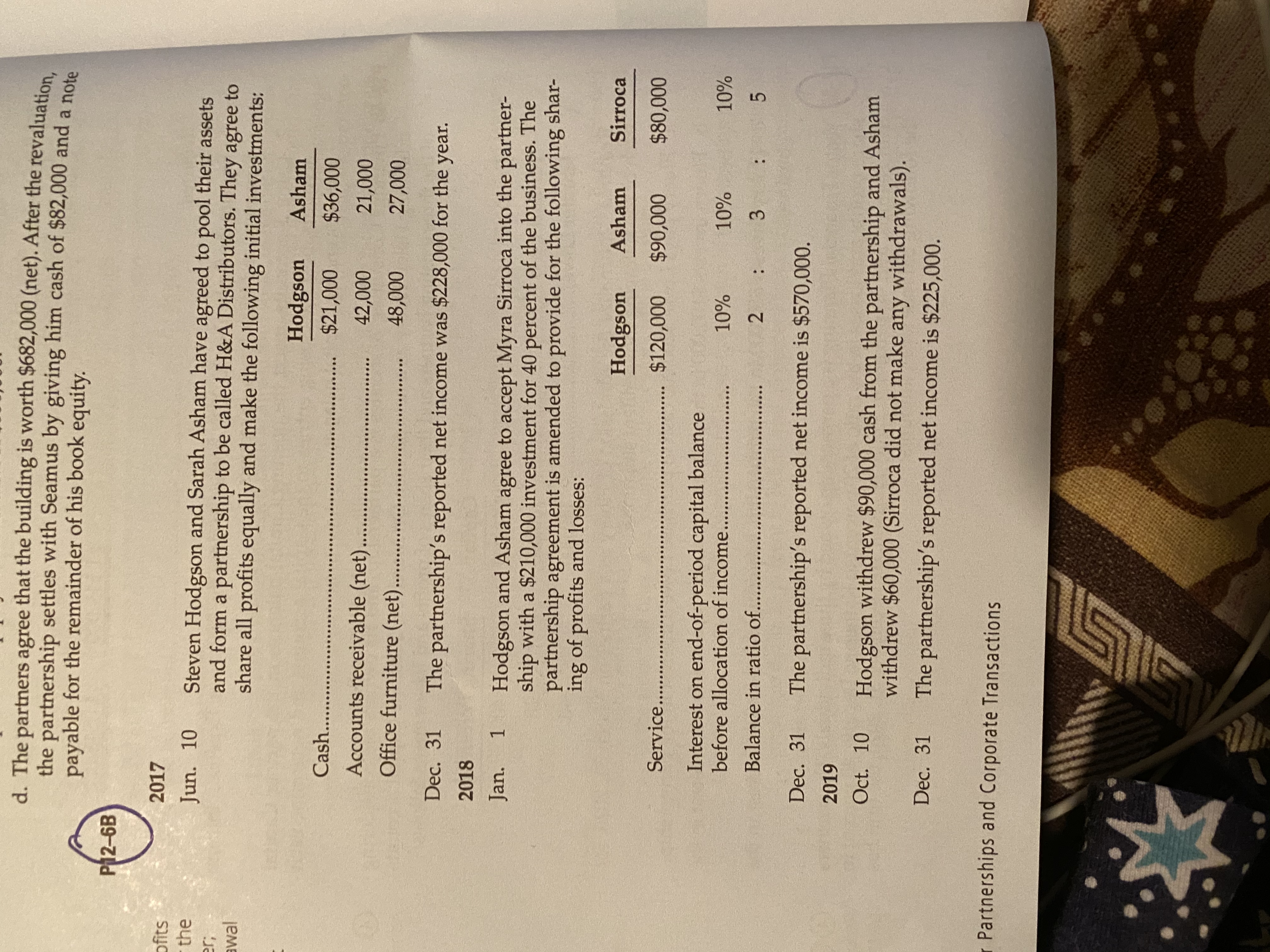

d. The partners agree that the building is worth $682,000 (net). After the revaluation, the partnership settles with Seamus by giving him cash of $82,000 and a note payable for the remainder of his book equity. P 12-6B ofits 2017 the Jun. 10 Steven Hodgson and Sarah Asham have agreed to pool their assets er wal and form a partnership to be called H&A Distributors. They agree to share all profits equally and make the following initial investments: Hodgson Asham Cash... $21,000 $36,000 Accounts receivable (net) 42,000 21,000 Office furniture (net) ...... 48,000 27,000 Dec. 31 The partnership's reported net income was $228,000 for the year. 2018 Jan. 1 Hodgson and Asham agree to accept Myra Sirroca into the partner- ship with a $210,000 investment for 40 percent of the business. The partnership agreement is amended to provide for the following shar- ing of profits and losses: Hodgson Asham Sirroca Service... $120,000 $90,000 $80,000 Interest on end-of-period capital balance before allocation of income........ 10% 10% 10% Balance in ratio of ..... 2 3 5 Dec. 31 The partnership's reported net income is $570,000. 2019 Oct. 10 Hodgson withdrew $90,000 cash from the partnership and Asham withdrew $60,000 (Sirroca did not make any withdrawals). Dec. 31 The partnership's reported net income is $225,000. Partnerships and Corporate Transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts