Question: need solution in a clear hand writing please 4a) Cash in Hand - AED 250,000, Cash at Bank-Half of Cash in Hand, Opening Debtors -

need solution in a clear hand writing please

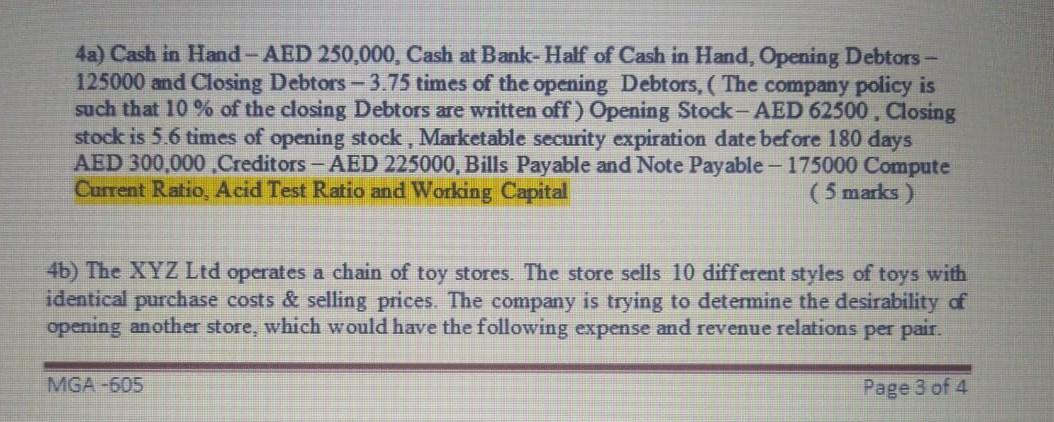

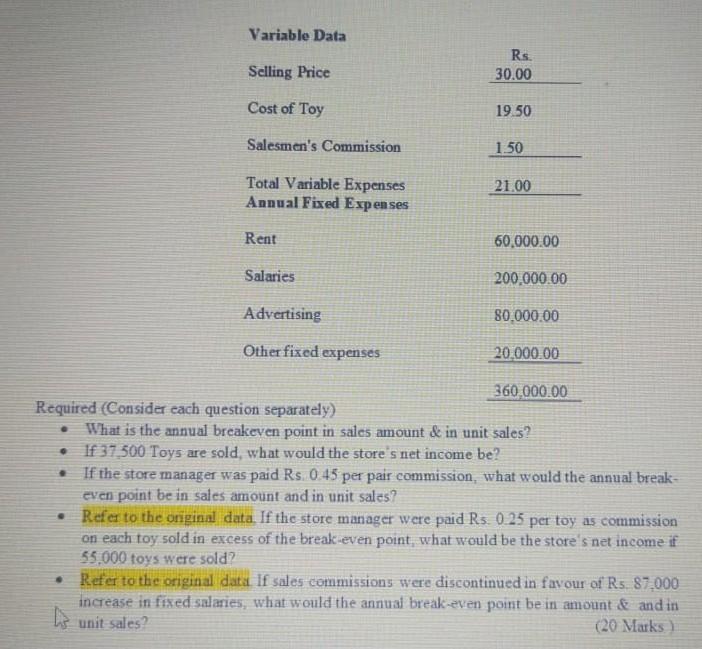

4a) Cash in Hand - AED 250,000, Cash at Bank-Half of Cash in Hand, Opening Debtors - 125000 and Closing Debtors - 3.75 times of the opening Debtors, ( The company policy is such that 10 % of the closing Debtors are written off) Opening Stock - AED 62500 , Closing stock is 5.6 times of opening stock , Marketable security expiration date before 180 days AED 300,000 Creditors - AED 225000, Bills Payable and Note Payable - 175000 Compute Current Ratio, Acid Test Ratio and Working Capital (5 marks) 4b) The XYZ Ltd operates a chain of toy stores. The store sells 10 different styles of toys with identical purchase costs & selling prices. The company is trying to determine the desirability of opening another store, which would have the following expense and revenue relations per pair. MGA -605 Page 3 of 4 Variable Data Selling Price Rs. 30.00 Cost of Toy 19.50 Salesmen's Commission 1.50 Total Variable Expenses Annual Fixed Expenses 21.00 Rent 60,000.00 Salaries 200,000.00 Advertising 80.000.00 Other fixed expenses 20.000.00 360,000.00 Required (Consider cach question separately) What is the annual breakeven point in sales amount & in unit sales? If 37.500 Toys are sold, what would the store's net income be? If the store manager was paid Rs. 0.45 per pair commission, what would the annual break- even point be in sales amount and in unit sales? Refer to the original data. If the store manager were paid Rs. 0.25 per toy as commission on each toy sold in excess of the break-even point what would be the store's net income if 55.000 toys were sold? Refer to the original data. If sales commissions were discontinued in favour of Rs. 87,000 increase in fixed salaries, what would the annual break-even pont be in amount & and in his unit sales? (20 MarksStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock