Question: Need Solution Problem 7: Pizza Pie Inc. enters into a franchisee agreement on December 31, 20x9, giving Sariwa Bake Shop the right to operate as

Need Solution

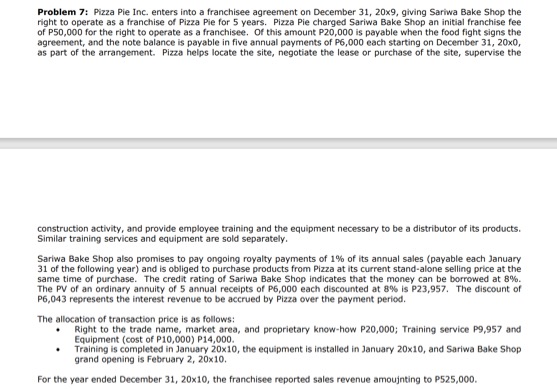

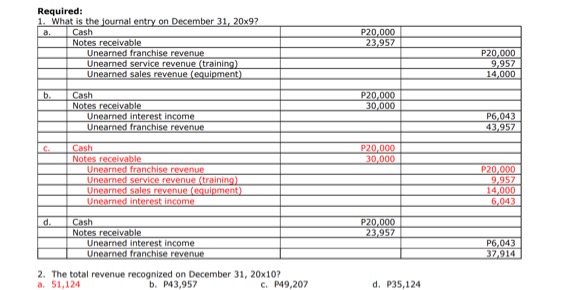

Problem 7: Pizza Pie Inc. enters into a franchisee agreement on December 31, 20x9, giving Sariwa Bake Shop the right to operate as a franchise of Pizza Pie for 5 years. Pizza Pie charged Sariwa Bake Shop an initial franchise fee of P50,000 for the right to operate as a franchisee. Of this amount P20,000 is payable when the food fight signs the agreement, and the note balance is payable in five annual payments of P6,000 each starting on December 31, 20x0, as part of the arrangement. Pizza helps locate the site, negotiate the lease or purchase of the site, supervise the construction activity, and provide employee training and the equipment necessary to be a distributor of its products. Similar training services and equipment are sold separately, Sariwa Bake Shop also promises to pay ongoing royalty payments of 1% of its annual sales (payable each January 31 of the following year) and is obliged to purchase products from Pizza at its current stand-alone selling price at the same time of purchase. The credit rating of Sariwa Bake Shop indicates that the money can be borrowed at 8%. The PV of an ordinary annuity of 5 annual receipts of P6,000 each discounted at 8% is P23,957. The discount of P6,043 represents the interest revenue to be accrued by Pizza over the payment period. The allocation of transaction price is as follows: Right to the trade name, market area, and proprietary know-how P20,000; Training service P9,957 and Equipment (cost of P10,000) P14,000. Training is completed in January 20x10, the equipment is installed in January 20x10, and Sariwa Bake Shop grand opening is February 2, 20x10. For the year ended December 31, 20x10, the franchisee reported sales revenue amoujnting to P525,000.Required: 1. What is the journal entry on December 31, 20x9? a. Cash P20,000 Notes receivable 23,957 Unearned franchise revenue P20 000 Unearned service revenue (training) 9,957 Unearned sales revenue (equipment) 14,000 Cash P20,000 Notes receivable 30,000 Unearned interest income P6,043 Unearned franchise revenue 43.957 C. Cash P20.DOO Notes receivable 30,000 Unearned franchise revenue P20 0.00 Unearned service revenue (training) 9.957 Unearned sales revenue (equipment) 14,000 Unearned interest income 6.043 Cash P20 000 Notes receivable 23,957 Unearned interest income P6,043 Unearned franchise revenue 37.914 2. The total revenue recognized on December 31, 20x10? a. 51,124 6. P43,957 C. P49,207 d. P35,124