Question: need solution urgent 6. A consol bond is a bond which forever pays a constant continuous coupon. We normalize the coupon to unity, so over

need solution urgent

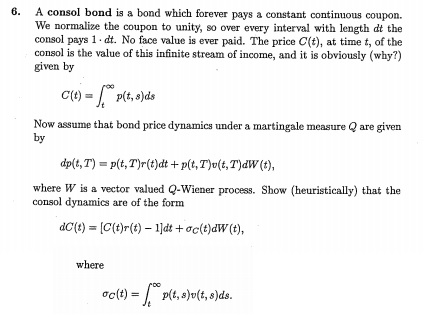

6. A consol bond is a bond which forever pays a constant continuous coupon. We normalize the coupon to unity, so over every interval with length de the consol pays 1 . dt. No face value is ever paid. The price O(t), at time t, of the consol is the value of this infinite stream of income, and it is obviously (why?) given by C(t) = p(t, s )da Now assume that bond price dynamics under a martingale measure @ are given by dp(t, T) = p(t, T)r(t)dt + p(t, T)o(t, T)dW(t), where W is a vector valued Q-Wiener process. Show (heuristically) that the consol dynamics are of the form do(t) = [C(t)r(t) - ldt + oc(t)dw (t), where oo(t) = p(t, s)v(t, s)de

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts