Question: need solution without excel formula 10. X-treme Vitamin Company is considering two investments, both of which cost $10,000. The cash flows are as follows: Year

need solution without excel formula

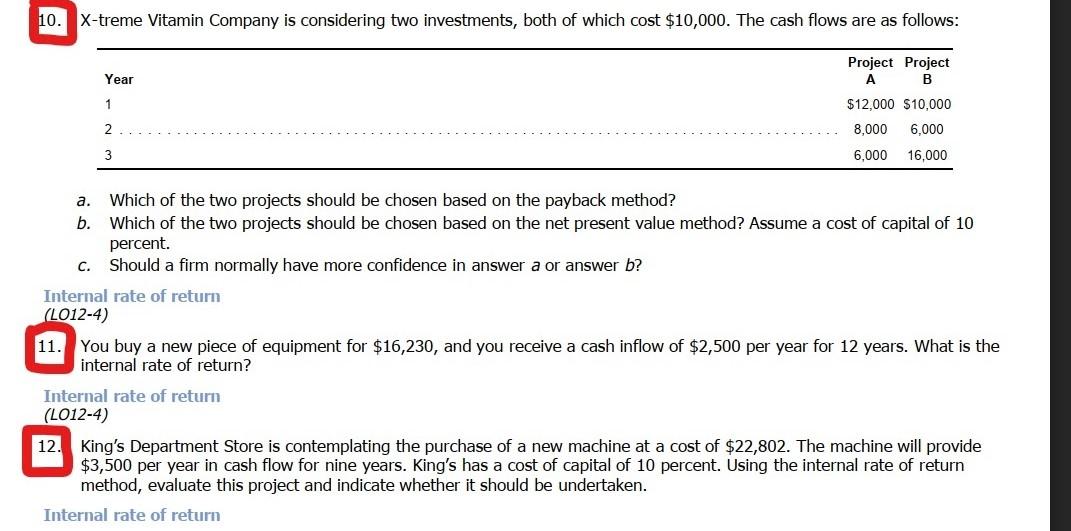

10. X-treme Vitamin Company is considering two investments, both of which cost $10,000. The cash flows are as follows: Year Project Project A B 1 $12,000 $10,000 8,000 6,000 2 3 6,000 16,000 C. a. Which of the two projects should be chosen based on the payback method? b. Which of the two projects should be chosen based on the net present value method? Assume a cost of capital of 10 percent. Should a firm normally have more confidence in answer a or answer b? Internal rate of return (L012-4) 11. You buy a new piece of equipment for $16,230, and you receive a cash inflow of $2,500 per year for 12 years. What is the internal rate of return? Internal rate of return (L012-4) 12. King's Department Store is contemplating the purchase of a new machine at a cost of $22,802. The machine will provide $3,500 per year in cash flow for nine years. King's has a cost of capital of 10 percent. Using the internal rate of return method, evaluate this project and indicate whether it should be undertaken. Internal rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts