Question: Need some help excel formatting. Answers go in the Bold outlined boxes . Correct percentages to the boxes are shown to the right of the

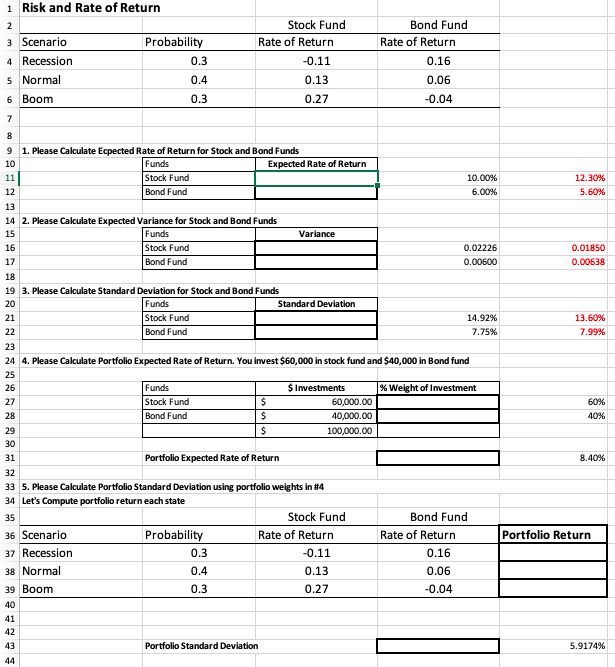

Need some help excel formatting. Answers go in the Bold outlined boxes. Correct percentages to the boxes are shown to the right of the boxes in black. (ignore the red percentages)

1 Risk and Rate of Return 2 3 Scenario Probability 4 Recession 0.3 5 Normal 0.4 Stock Fund Rate of Return -0.11 0.13 Bond Fund Rate of Return 0.16 0.06 6 Boom 0.3 0.27 -0.04 7 10.00% 6.00% 12.30% 5.60% 8 9 1. Please Calculate Ecpected Rate of Return for Stock and Bond Funds 10 Funds Expected Rate of Return 11 Stock Fund 12 Bond Fund 13 14 2. Please Calculate Expected Variance for Stock and Bond Funds 15 Funds Variance 16 Stock Fund 17 Bond Fund 0.02226 0.00600 0.01850 0.00638 13.60% 7.99% 60% 40% 18 19 3. Please Calculate Standard Deviation for Stock and Bond Funds 20 Funds Standard Deviation 21 Stock Fund 14.92% 22 Bond Fund 7.75% 23 24 4. Please Calculate Portfolio Expected Rate of Return. You invest $60,000 in stock fund and $40,000 in Bond fund 25 26 Funds $ Investments % Weight of Investment 27 Stock Fund $ 60,000.00 28 Bond Fund $ 40,000.00 29 $ 100,000.00 30 31 Portfolio Expected Rate of Return 32 33 5. Please Calculate Portfolio Standard Deviation using portfolio weights in #4 34 Let's Compute portfolio return each state 35 Stock Fund Bond Fund 36 Scenario Probability Rate of Return Rate of Return 37 Recession 0.3 -0.11 0.16 38 Normal 0.4 0.13 0.06 39 Boom 0.3 0.27 -0.04 8.40% Portfolio Return 40 41 42 43 Portfolio Standard Deviation 5.9174% 44 1 Risk and Rate of Return 2 3 Scenario Probability 4 Recession 0.3 5 Normal 0.4 Stock Fund Rate of Return -0.11 0.13 Bond Fund Rate of Return 0.16 0.06 6 Boom 0.3 0.27 -0.04 7 10.00% 6.00% 12.30% 5.60% 8 9 1. Please Calculate Ecpected Rate of Return for Stock and Bond Funds 10 Funds Expected Rate of Return 11 Stock Fund 12 Bond Fund 13 14 2. Please Calculate Expected Variance for Stock and Bond Funds 15 Funds Variance 16 Stock Fund 17 Bond Fund 0.02226 0.00600 0.01850 0.00638 13.60% 7.99% 60% 40% 18 19 3. Please Calculate Standard Deviation for Stock and Bond Funds 20 Funds Standard Deviation 21 Stock Fund 14.92% 22 Bond Fund 7.75% 23 24 4. Please Calculate Portfolio Expected Rate of Return. You invest $60,000 in stock fund and $40,000 in Bond fund 25 26 Funds $ Investments % Weight of Investment 27 Stock Fund $ 60,000.00 28 Bond Fund $ 40,000.00 29 $ 100,000.00 30 31 Portfolio Expected Rate of Return 32 33 5. Please Calculate Portfolio Standard Deviation using portfolio weights in #4 34 Let's Compute portfolio return each state 35 Stock Fund Bond Fund 36 Scenario Probability Rate of Return Rate of Return 37 Recession 0.3 -0.11 0.16 38 Normal 0.4 0.13 0.06 39 Boom 0.3 0.27 -0.04 8.40% Portfolio Return 40 41 42 43 Portfolio Standard Deviation 5.9174% 44

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts