Question: need some help for this question Q10. (10 marks) For a portfolio selection problem based on three risky assets, the 3 x 3 covariance of

need some help for this question

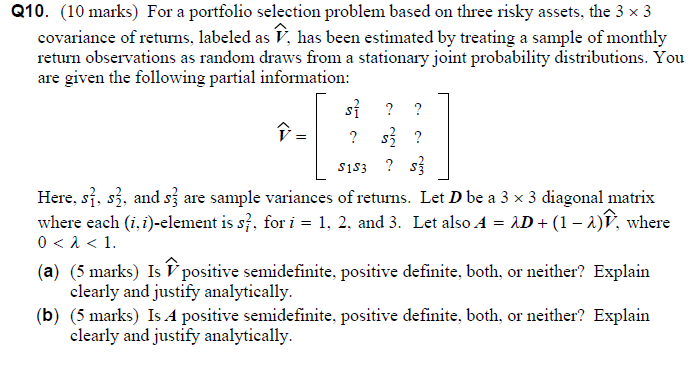

Q10. (10 marks) For a portfolio selection problem based on three risky assets, the 3 x 3 covariance of returns, labeled as I', has been estimated by treating a sample of monthly return observations as random draws from a stationary joint probability distributions. You are given the following partial information: si -9 Here, s1. $5, and s; are sample variances of returns. Let D be a 3 x 3 diagonal matrix where each (i, i)-element is s?, for i = 1, 2, and 3. Let also A = AD + (1 -A)V, where 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts