Question: Need some help using question 1 for problem 2, thanks! Only need to answer problem 2 Calculate the fair price/value in US Dollar of the

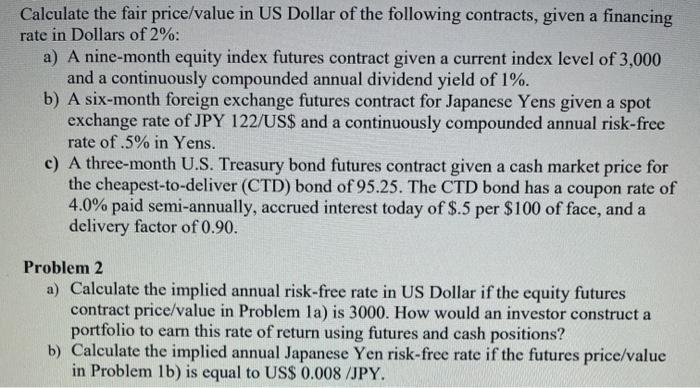

Calculate the fair price/value in US Dollar of the following contracts, given a financing rate in Dollars of 2%: a) A nine-month equity index futures contract given a current index level of 3,000 and a continuously compounded annual dividend yield of 1%. b) A six-month foreign exchange futures contract for Japanese Yens given a spot exchange rate of JPY 122/US$ and a continuously compounded annual risk-free rate of .5% in Yens. c) A three-month U.S. Treasury bond futures contract given a cash market price for the cheapest-to-deliver (CTD) bond of 95.25. The CTD bond has a coupon rate of 4.0% paid semi-annually, accrued interest today of $.5 per $100 of face, and a delivery factor of 0.90. Problem 2 a) Calculate the implied annual risk-free rate in US Dollar if the equity futures contract price/value in Problem la) is 3000. How would an investor construct a portfolio to earn this rate of return using futures and cash positions? b) Calculate the implied annual Japanese Yen risk-free rate if the futures price/value in Problem 1b) is equal to US$ 0.008 /JPY. Calculate the fair price/value in US Dollar of the following contracts, given a financing rate in Dollars of 2%: a) A nine-month equity index futures contract given a current index level of 3,000 and a continuously compounded annual dividend yield of 1%. b) A six-month foreign exchange futures contract for Japanese Yens given a spot exchange rate of JPY 122/US$ and a continuously compounded annual risk-free rate of .5% in Yens. c) A three-month U.S. Treasury bond futures contract given a cash market price for the cheapest-to-deliver (CTD) bond of 95.25. The CTD bond has a coupon rate of 4.0% paid semi-annually, accrued interest today of $.5 per $100 of face, and a delivery factor of 0.90. Problem 2 a) Calculate the implied annual risk-free rate in US Dollar if the equity futures contract price/value in Problem la) is 3000. How would an investor construct a portfolio to earn this rate of return using futures and cash positions? b) Calculate the implied annual Japanese Yen risk-free rate if the futures price/value in Problem 1b) is equal to US$ 0.008 /JPY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts